The European Stoxx 600 index also achieves a record close, as strong Nvidia results stoke optimism in tech companies.

Japan’s main stock index, European shares, and Wall Street’s S&P 500 have all reached all-time highs, as good results from chipmaker Nvidia fuel investor excitement about an artificial intelligence investment boom.

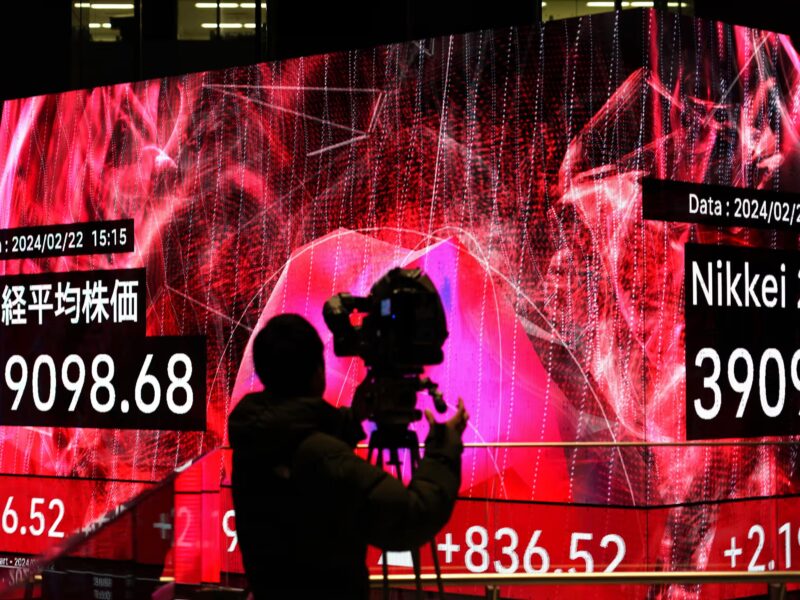

The Nikkei rose 2.19% to close at 39,098.68. On the last trading day of 1989, it finished at 38,915.87. It has taken 34 years to regain its footing, which is a decade longer than it took Wall Street to recover losses from the 1929 crisis and Great Depression.

On Thursday, Europe’s Stoxx 600 index closed at a record 495.10. In the United States, the tech-heavy Nasdaq, where Nvidia is listed, rose more than 2% at the open to 15,920. The Dow Jones advanced over 250 points, or 0.6%, to 38,858, while the S&P 500 climbed 82 points, or 1.6%, to a record high of 5,063.55.

Nvidia stock surged 15% as trading resumed a day after the company revealed positive earnings. On Wednesday, Nvidia anticipated quarterly revenue well beyond Wall Street’s already lofty projections, boosting tech stocks around the world.

The advances bring Nvidia’s market worth close to $2 trillion, having increased by $260 billion to $1.9 trillion on Thursday, just nine months after topping $1 trillion. If Nvidia maintains its early gains, it will set a record for the largest single-day increase in a company’s stock market value.

Although the strong Nvidia results and accompanying optimism about tech stocks helped drive the Nikkei to a record high, the Tokyo index has been bolstered in recent years by other factors, including hope that Japan is finally overcoming its historical problems with flat or falling prices, as well as investor concerns about the Chinese economy.

A decline in the value of the yen has also enticed overseas investors to the Nikkei.

Nvidia’s results were regarded as “the biggest moment for the market and tech sector in many years” by one analyst.

“This was a ‘gamechanging moment’ for the tech bulls and puts jet fuel in the tech bull market thesis,” said Dan Ives, an analyst at Wedbush Securities in the United States.

On Thursday, Nvidia CEO Jensen Huang stated that the AI sector has reached “the tipping point”. He went on to say: “Demand is surging worldwide across companies, industries and nations.”

Nvidia’s gains lifted AI competitor Advanced Micro Devices by 10% in early trading, while Super Micro Computer surged 20% and UK-based Arm Holdings rose 9%.

Soaring demand for Nvidia chips, which are utilized by corporations hurrying to enhance their AI products, led the Silicon Valley company anticipate first-quarter revenue growth of 233%, exceeding Wall Street expectations of 208%.

The midpoint of the prediction was $24 billion, which exceeded market forecasts of $22.2 billion.

Josh Gilbert, an eToro market analyst, stated: “Nvidia continues to perform in every aspect, and its results demonstrate that there is still plenty of room for development. This isn’t a passing fad or a bubble, but rather a thriving enterprise.”

Expectations were high going into the report, with Nvidia shares rising about 36% this year to become the best-performing S&P 500 company, setting a new high only last week.

The share increase that fueled the S&P 500’s march to new highs this year raised concerns that growth at Nvidia, regarded as a barometer for AI demand, might disappoint and could undermine the market rally.