The sentiment on Wall Street is mostly positive, but there are reasons to exercise caution.

While recent market performance has been optimistic, a closer look reveals underlying issues. The S&P 500 reached a two-year high, and the Dow exceeded 38,000 for the first time ever. In Europe, Germany’s DAX hit an all-time high, and the STOXX index is approaching a new record. Additionally, real bond yields are near six-month lows, and favorable financial conditions, with declining borrowing costs, may support economic growth.

However, the gains on Wall Street are not widespread; they are concentrated. Notably, Nvidia and Microsoft alone accounted for approximately 75% of the S&P 500’s gains this year, with the top 20 stocks contributing 110% of the index’s growth, while the remaining 480 stocks had a more limited impact. This concentration of gains in a few stocks poses inherent risks, as any shift in sentiment towards these companies could impact overall equity gains.

The economy appears robust, with resilient economic data in recent months, including a low unemployment rate of 3.7% compared to a Fed prediction of 4.6% a year ago. Consumer sentiment has reached its highest level since July 2021, and retail sales increased by 0.6% in December. Economists surveyed by the National Association of Business Economics overwhelmingly believe that the US will avoid a recession this year. Inflation rates have also been easing, with consumers expecting further reductions.

However, investors tend to adjust their expectations as strong data becomes the norm, and any signs of economic weakening could lead to a downturn in stocks.

Furthermore, there is discussion among Fed officials about potential interest rate cuts this year, with some indicating a willingness to lower rates if inflation remains in check. Financial markets currently suggest a significant probability of rate cuts by March or May, but expectations have evolved recently, reflecting uncertainty regarding inflation and economic conditions.

Artificial intelligence (AI) has played a significant role in the recent equity rally, with the potential to enhance productivity in various industries. AI’s ability to make jobs more efficient is seen as a positive factor, potentially even mitigating inflation. However, the tech sector has experienced job cuts at the beginning of the year, coinciding with increased investments in AI. The ongoing labor changes in the tech industry may foreshadow broader workforce disruptions as AI continues to reshape various sectors in the future.

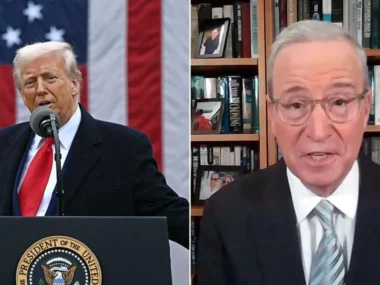

“The final straw in a series of frustrations”: United CEO’s exasperation with Boeing.

United Airlines, a major purchaser of Boeing aircraft, is growing increasingly frustrated with the aircraft manufacturer due to its ongoing quality issues. Scott Kirby, CEO of United, expressed disappointment in Boeing’s recurring manufacturing challenges during an interview on CNBC, emphasizing the need for Boeing to address these issues.

This frustration came to the forefront as United Airlines warned investors about an anticipated larger-than-expected loss in the first quarter of the year. This setback is primarily attributed to the grounding of all 737 Max 9 jets after an incident on an Alaska Airlines flight on January 5, where a door plug blew off, causing significant damage to the aircraft’s side. Although the plane landed without major injuries, the Federal Aviation Administration mandated grounding and additional inspections of over 200 jets of the same model globally.

United Airlines now expects its Boeing Max 9 jets to remain grounded until the end of the month, resulting in an estimated first-quarter loss ranging from $116 million to $262 million. This exceeds the previously forecasted loss of $138 million by analysts surveyed by Refinitiv.

Beyond the immediate issue with the 737 Max 9, there are concerns about the impact on Boeing’s orders for the 737 Max 10, a newer, larger, and more expensive version of the 737 Max awaiting certification from the FAA. According to Kirby, it could be at least five years in the best-case scenario before United receives these Max 10 jets from Boeing. As a result, the airline is reconsidering its plans and no longer counting on the Max 10 for its future needs.

Boeing’s stock experienced a 1.6% decline on Tuesday, while United Airlines’ shares saw a 5.3% increase.

In the fourth quarter, Netflix added over 13 million subscribers to its user base.

Netflix has reported a significant surge in sign-ups for the fourth quarter, surpassing expectations with the addition of over 13 million subscribers, compared to the anticipated 8.7 million according to Wall Street forecasts. As a result, Netflix’s stock experienced an almost 10% increase in pre-market trading.

Over the past year, Netflix has introduced several initiatives to boost its subscriber base. These efforts include cracking down on password-sharing, prompting users who were sharing passwords to create their own subscriptions. Additionally, the company introduced a lower-priced advertising-supported subscription tier priced at $6.99.

In recent developments, Amy Reinhard, Netflix’s President of Advertising, revealed that the advertising-supported tier had attracted over 23 million monthly memberships.

In a letter to shareholders, Netflix declared the password-sharing crackdown a success, stating that they believe they have effectively addressed account sharing and ensured that users who enjoy Netflix also pay for the service.

Looking ahead to 2024, Netflix has expressed optimism about enhancing its core TV and film content and expanding its offerings to include gaming, live entertainment, and sports programming, identifying these areas as “big opportunities” for growth.