The US dollar has experienced significant drops in recent months.

While currencies fluctuate regularly, the recent decline of the dollar has been especially sharp.

So, what’s behind the dollar’s fall, and why is it important?

What has happened to the dollar since Trump was elected?

In the lead-up to the 2024 presidential election, the dollar strengthened through the autumn, driven by solid US economic growth. It continued to rise after Trump’s November win, fueled by hopes he would maintain this growth trend.

Discussions about his trade policy also influenced the market, as many investors anticipated that the tariffs he pledged would raise inflation, prompting the US central bank to increase interest rates or at least slow down rate cuts.

The possibility of higher rates in the US made the dollar more appealing, as investors would earn more on their dollar-denominated assets compared to other currencies.

However, in recent months, as more details of his tariffs emerged—often followed by delays or, in China’s case, extensions—uncertainty about their impact grew.

US economic growth is now widely predicted to slow, leading to a decline in the dollar, which has seen significant losses. Trump’s criticism of Fed Chairman Jerome Powell for not reducing interest rates also seems to have added downward pressure on the dollar.

The value of currencies fluctuates due to various factors, including inflation expectations and central bank policies.

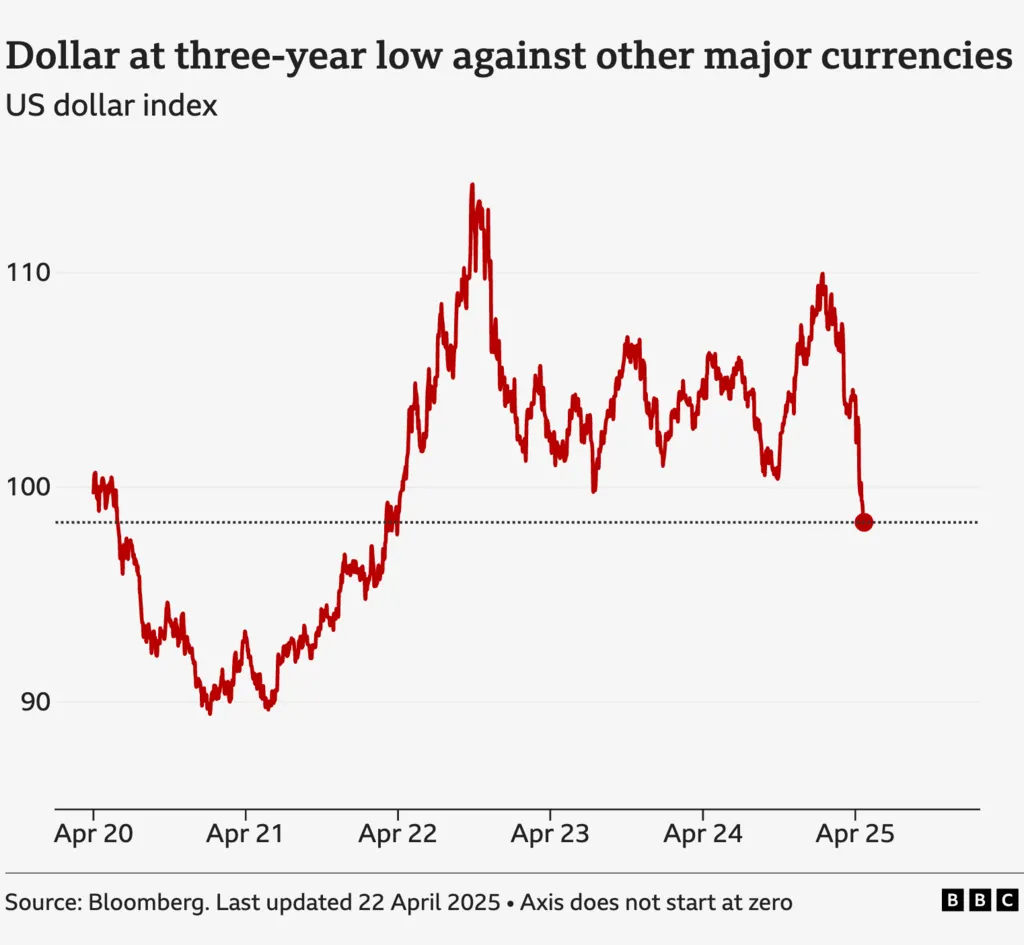

However, the dollar index, which gauges the dollar’s strength against a basket of currencies, has dropped to its lowest level in three years.

Is this uncommon?

The dollar is typically viewed as a safe investment during uncertain times.

Therefore, the significant decline in the currency, along with the recent sell-off in US government bonds—also regarded as a secure asset—is unusual.

The drop in the dollar following Trump’s “Liberation Day” tariff announcement was “quite shocking,” according to Jane Foley, head of foreign exchange strategy at Rabobank.

“For years, the market has been backing the US growth story, with the US stock market outperforming others, and suddenly economists were predicting that tariffs could push the US into a recession,” she explains, noting the large sell-offs of US stocks, bonds, and the dollar.

This has sparked speculation that the decline could signal a broader shift away from the US and the dollar.

What does a decline in the dollar indicate?

Ordinary Americans might first notice a weaker dollar when traveling abroad, as their money will have less purchasing power. On the other hand, foreign tourists in the US will find their currency can buy more.

However, changes in the dollar also have a significant global impact, more so than fluctuations in other currencies.

This is because the dollar is the world’s primary reserve currency, held by central banks worldwide in large amounts as part of their foreign exchange reserves. Central banks use US dollars for international transactions, paying off international debt, or managing domestic exchange rates.

Additionally, the dollar is the dominant currency in global trade, with about half of international trade invoices denominated in US dollars, according to Jane Foley.

When the dollar weakens, US exports become cheaper, but imported goods may rise in price due to the weaker currency and potential tariff effects.

Many globally traded commodities, such as oil and gas, are priced in dollars. A weaker dollar makes crude oil less expensive for countries holding other currencies.

What would occur if the dollar continues to decline?

In the US, a strong dollar has long been viewed as a symbol of American political power.

The notion that the dollar could lose its status as the world’s reserve currency has seemed unimaginable.

Ms. Foley argues that while other currencies might gain importance, the dollar is unlikely to lose its top position anytime soon. However, one Federal Reserve official did suggest last year that the US can no longer take this status for granted.

Ms. Foley believes the dollar will recover some of its value in the coming weeks, though it won’t return to previous levels.

This is because major market movements often trigger profit-taking. For example, if investors sell euros while the currency is strong, it could cause the euro to drop and the dollar to rise.

The markets will be observing this week to see if Trump continues his criticism of Federal Reserve Chairman Jerome Powell. Trump has called Powell “a major loser” and publicly demanded his “termination.”

If pressure mounts on Powell to step down, the markets will start to question the Fed’s credibility, which is crucial for confidence in monetary policy.

“The independence of central banks is vital to ensuring long-term price stability and protecting policymakers from short-term political pressures,” says Susannah Streeter, head of money and markets at Hargreaves Lansdown.