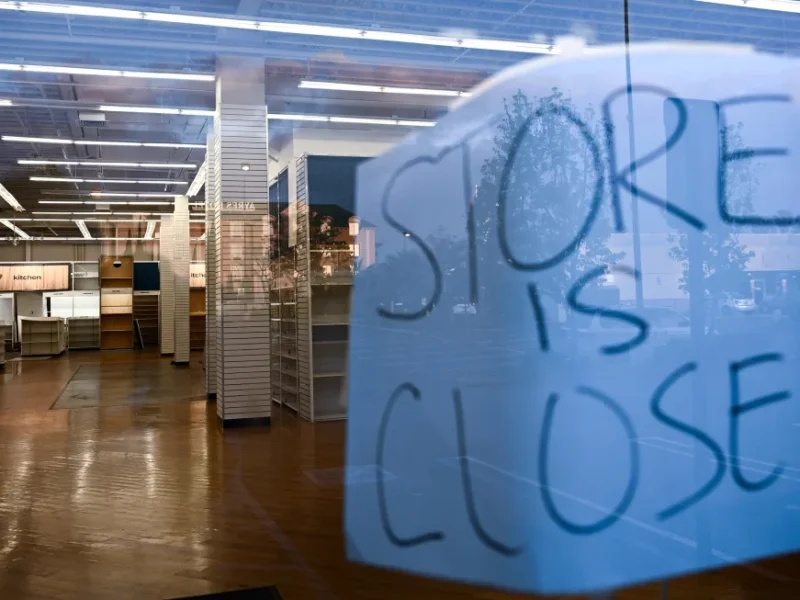

When the AMC 24 Hamilton ceased operations in November 2020, many local residents in New Jersey might have collectively expressed disappointment or regarded it as another unfortunate consequence of the pandemic-driven economy.

However, for nearby businesses, the absence of the theater posed a significant challenge. Jim Danay, representing Bock Group, the owner of UNO Pizzeria & Grill in Hamilton, revealed a decline of 30% to 40% in sales. Although the UNO location has somewhat recovered since the closure of AMC 24 Hamilton, sales still fall short of the levels during the theater’s operation. The restaurant had previously collaborated with the theater on a promotion offering customers a discounted movie ticket.

The UNO and AMC 24 Hamilton scenario highlights a broader issue concerning the dynamic between large and small businesses, the crucial role of foot traffic for retailers, and the primary factors influencing brick-and-mortar establishments.

Experiencing a decline in local engagement.

The closure of destination establishments, such as movie theaters or sporting complexes, can have significant repercussions extending beyond immediate sales impacts for smaller businesses in the vicinity.

The mere existence of such establishments plays a vital role in providing exposure for restaurants, specialty stores, and kiosk businesses that might otherwise go unnoticed by a large portion of consumers.

Stephanie Cegielski, a vice president at the retail-trade organization ICSC, notes that having such tenants leads to people visiting a center and being exposed to other businesses, serving as cost-effective advertising for small enterprises and raising brand awareness.

When a major source of foot traffic shuts down, local economies may feel the consequences. John Deskins, director of West Virginia University’s Bureau of Business and Economic Research, points out that it diminishes overall demand and activity in the community, potentially leading to contraction.

The closures can result in job losses and a reduction in crucial tax revenue for local governments. Consumers who prefer shopping centers over online purchases may redirect their business to nearby towns. Between 2019 and the end of 2021, many retailers closed locations in dense city centers and shifted to suburbs, a trend driven by the increase in remote work during the pandemic, causing individuals to spend more money in their local areas rather than in the cities where their offices were situated, according to research from the JPMorgan Chase Institute.

The significance of location and appearances cannot be overstated.

The primary driver of foot traffic is predominantly determined by the location of businesses rather than just the types of businesses operating, according to Brandon Isner, CBRE’s head of retail research for the Americas.

There is still a remarkably high demand for retail space in prime locations, and availability is currently at an unprecedented low. With major retailers competing for space in bustling centers, businesses are becoming less dependent on a single crucial retailer.

When significant businesses close in less vibrant commercial areas, those vacancies are less likely to be filled due to a more focused approach in recent years regarding new openings. Retailers now leverage sophisticated data analysis to pinpoint optimal locations, moving away from the past strategy of opening multiple stores in a market and hoping for success.

Appearances play a crucial role in attracting and retaining big retailers in spaces like strip malls. Small businesses can thrive when surrounded by popular large enterprises, but an unattractive location can act as a deterrent for major companies.

Brandon Isner suggests that a substantial reinvestment could be a solution for struggling retail centers. He emphasizes the impact of aesthetics, noting that “Paint is one of the best returns on a dollar.”

A particular fixture in physical retail distinguishes itself.

Opting for proximity to a grocery store may be the optimal choice for a small business, given its status as a consistent cornerstone in the evolving retail landscape.

According to Isner, a grocery store continues to be a dependable generator of foot traffic. Many retailers are now seeking locations in grocery-anchored centers to capitalize on in-store customer numbers because, even in challenging economic times, people consistently need to purchase groceries.

“In a recession, grocery stores will maintain their traffic because people will be eating out less at restaurants, and so they’ll be buying more groceries,” explained Isner. “There’s a lot of power in being next to that traffic that’s going into a grocery store all the time.”

Retailers specializing in clothing, sporting goods, and personal care items find particular success in these grocery-centric retail centers, as their products typically don’t overlap with customers’ weekly grocery lists.

Given the established foot traffic generated by grocery stores, the departure of a major grocery retailer, such as ShopRite or Publix, from a retail center has the potential to significantly impact neighboring businesses. Isner emphasizes that the closure of a grocery store in a smaller center could pose substantial challenges for all the retailers within it.