Stocks are recovering on Tuesday after another rough day on Wall Street. However, a single positive trading session can’t mask the warning signs flashing across U.S. financial markets.

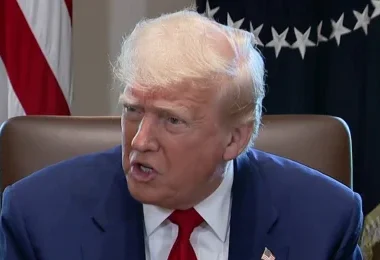

The reason is clear: investors are signaling that President Donald Trump’s trade war is turning the U.S. into a risky environment for investment.

This becomes evident when observing broader market trends and the assets traders are currently favoring—or more accurately, offloading.

US stocks

Trump’s stock market is producing some staggering numbers—so striking that it’s drawing parallels to the Great Depression.

In just the first three weeks of April, the Dow Jones Industrial Average has dropped 9.1%, marking its worst April performance since 1932. The only April that fared worse was in 1931.

Meanwhile, the S&P 500 has fallen 14% during Trump’s first term, making it the poorest showing through April 21 for any U.S. president since tracking began in 1928, according to Bespoke Investments. Even with a slight recovery on Tuesday—where major indexes climbed over 2%—Trump faces a steep uphill battle to avoid setting a historic low. The next worst start for a president came in 1941 under Franklin D. Roosevelt, when markets fell just over 9% in the first 63 trading days.

Dollar

At the same time, traders have largely turned away from the U.S. dollar. Since the start of Trump’s new term, the dollar has dropped 5.5%—the steepest early-term decline on record since data tracking began under President Gerald Ford in 1974.

The only comparable drop occurred during Trump’s first term, when the dollar slipped 3% in the first 63 trading days.

On Monday, the dollar reached a three-year low.

Bonds

Normally, when markets get shaky, investors flock to U.S. Treasury bonds—long considered the ultimate safe-haven asset. But this time, that pattern has broken: government bonds are seeing sharp sell-offs.

As a result, yields—which move inversely to bond prices—have spiked. The 10-year U.S. Treasury yield has jumped to 4.4%, just a month after falling below 4%. Such rapid swings are highly unusual in the bond market.

Foreign stocks

As investors move their funds out of U.S. stocks and bonds, they’re shifting capital into global markets. Since the beginning of Trump’s new term, the MSCI All World Index—excluding the U.S.—has climbed 2.9%.

That performance is nearly in line with the early days of former President Joe Biden’s term and just slightly behind the start of Trump’s first term—both times when U.S. markets were also seeing strong gains.

Oil

Worried about a potential global recession, traders have sharply pulled back from oil, leading to the worst early-term performance for U.S. crude under any president since Bill Clinton’s second term, according to Bespoke.

During Trump’s second term, oil prices have dropped 19%, driven by concerns that demand for travel and shipping could collapse. For comparison, oil fell nearly 24% in early 1997 at the beginning of Clinton’s second term.

Gold

At the same time, investors are seeking safer assets—and gold has become a top choice. On Tuesday, it climbed past $3,500 an ounce, setting a new all-time high.

Since the beginning of Trump’s new term, gold has soared nearly 25%, easily surpassing the previous record of 13.5% set during the early months of Jimmy Carter’s presidency in 1977. No other president has seen a gold rally of this scale so early in their term.

What’s happening?

Trump’s trade war is causing significant disruptions to the global economy, according to a report from the International Monetary Fund on Tuesday.

The IMF warned that the global economic system, which has functioned for the past 80 years, is undergoing a major reset. The report forecasted a sharp slowdown in economic growth, especially in the United States, while inflation is expected to rise again.

This challenging combination of stagnating growth and escalating inflation is difficult to address. While economists don’t anticipate a repeat of the stagflation seen in the 1970s, the rapid shifts in global trade are creating considerable uncertainty and anxiety among consumers, businesses, and traders.

The IMF also mentioned that Trump’s April 2 “Liberation Day” tariff announcement, which introduced 10% tariffs and reciprocal tariffs on several countries, forced them to revise their projections. While these tariffs were later paused for 90 days, the move created confusion.

Goldman Sachs CEO David Solomon commented on CNBC, highlighting that the unpredictability of Trump’s policies has hindered businesses from adapting effectively. He stressed that the high level of uncertainty is unproductive and will likely impact economic growth in the near future.