If you’ve been eagerly waiting for financial relief from the Federal Reserve, you might be in for a disappointment.

After maintaining interest rates at a 23-year high for over a year, the Fed is expected to announce a reduction in its benchmark lending rate on Wednesday. Additionally, Fed Chair Jerome Powell might indicate that further reductions could occur in future meetings.

If this happens, it could be the moment investors have been anticipating since the Fed began raising rates in March 2022 to control inflation. This potential cut could even drive stocks to new highs.

However, don’t expect immediate or substantial changes. Most Americans might not notice much difference from a single rate cut, or even several, for at least a year or more.

How rate cuts work?

Central banks typically reduce interest rates for one of two reasons: either they anticipate a severe downturn in financial conditions or inflation has decreased to a point where maintaining high rates would overly constrain the economy. Currently, many economists think the Fed will cut rates due to the latter reason.

When the Fed aims to ease economic pressure, it lowers its target federal funds rate. This is the rate at which commercial banks lend to each other to meet reserve requirements. To achieve this reduction, the Fed buys securities, such as Treasury notes and mortgage-backed securities. By purchasing these assets, the Fed injects cash into the banking system, increasing the amount of money banks have available to lend. This additional liquidity typically leads banks to lower interest rates on loans and mortgages.

Although the immediate effect is a reduction in loan rates, the broader impact of rate cuts often takes longer to become apparent.

How rate cuts work their way through the economy?

Interest rate levels influence a broad range of decisions made by individuals, businesses, and the government.

To put it simply, when rates are low, borrowing becomes more affordable compared to times when rates are high. With the expected rate cut on Wednesday, businesses might find it more financially sensible to invest in new initiatives or hire additional workers, as they will have less cash tied up in loan repayments.

For consumers, lower interest rates can encourage spending rather than saving, as returns on savings accounts tend to decrease. While businesses may eventually respond to increased demand by raising prices, this process doesn’t happen immediately after the Fed lowers rates, according to Thomas Drechsel, an economics professor at the University of Maryland.

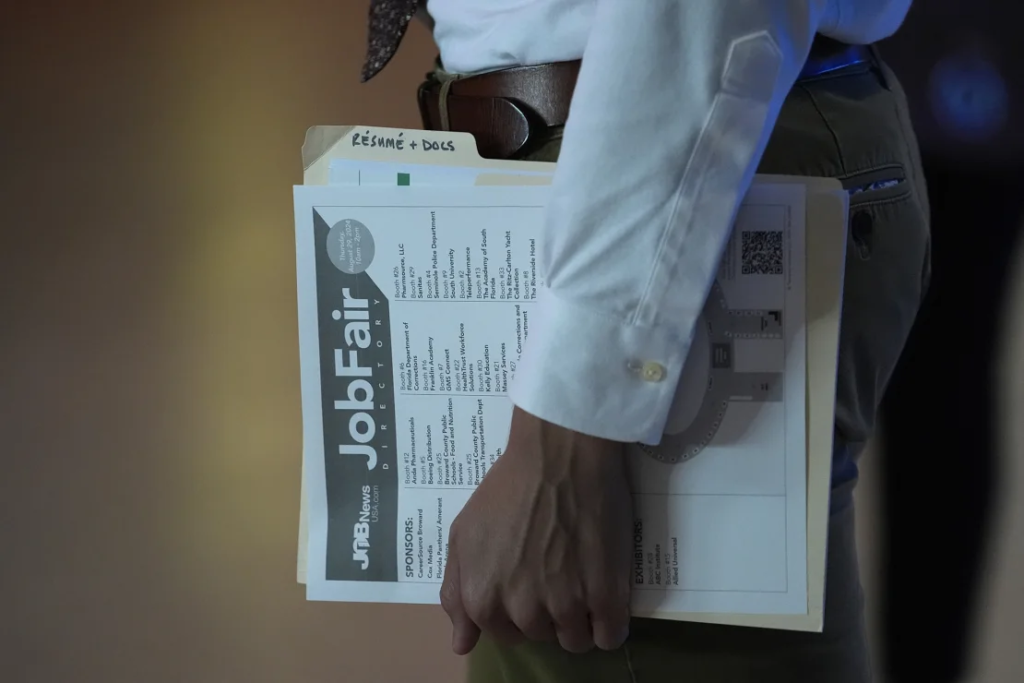

Business’ hiring decisions can be influenced by the Federal Reserve’s interest rate decisions. When rates are lower, businesses may be more inclined to expand their workforce.

Consider your Netflix subscription, as an example: it’s unlikely for Netflix to adjust its pricing on a weekly or monthly basis. Similarly, if Netflix experiences a surge in new subscriptions following a Fed rate cut, it won’t necessarily be able to immediately increase prices in response. This is because many businesses are bound by existing contracts that prevent immediate price changes. Consequently, the full impact of the Fed’s rate adjustments on the economy takes time to materialize.

Nobel Prize-winning economist Milton Friedman described this delay as “long and variable lags.” Thomas Drechsel compared it to steering a large ship; even though the wheel is turned, it takes time for the ship to change course. The exact length of this lag is still uncertain. Some economists believe it takes about a year for the effects to become noticeable, which could explain why inflation began to decrease significantly in 2023, a year after the Fed’s rate hikes began. However, Drechsel’s research suggests that it may take several years for the full impact to be evident in economic data.

This means that while some effects of rate changes may be felt early on, the complete impact often unfolds over an extended period, and prior rate hikes may still be influencing the economy.