Waiting for clarity: The US economy has seen some dramatic shifts in recent days.

President Donald Trump’s critiques of Federal Reserve Chair Jerome Powell are impacting the markets. Investors are raising concerns with their buying and selling patterns, drawing comparisons to the Great Depression. Meanwhile, entities like the International Monetary Fund and Trump’s wealthy associates are issuing serious warnings about his substantial tariffs.

Here’s what you might have missed this week.

Trump labels his Fed chair as ‘a major loser’.

Presidential relationships can evolve, but Trump has taken it to the extreme.

After referring to the Fed chair (whom he appointed in 2018) as “a major loser” and stating that his “termination cannot come soon enough” last week, Trump appeared to shift his stance on Tuesday. He stated he had “no intention” of firing Powell after advisers cautioned that dismissing the central bank head would have legal and economic repercussions, according to sources familiar with the matter.

Federal Reserve Chair Jerome Powell addresses an event in Chicago on April 16.

However, the president’s perspective took a negative turn by Wednesday.

“I haven’t called him. I might call him,” Trump said during an Oval Office executive action signing ceremony on Wednesday evening. “I believe he’s making a mistake by not lowering interest rates, and I think, despite our progress, we could do much better.”

Trump reaffirms his commitment to his tariff agenda.

On Wednesday, Trump mentioned that he could reintroduce “reciprocal” tariffs on certain countries within two or three weeks. Earlier this month, the president had paused his extensive so-called reciprocal tariffs, which aren’t technically reciprocal, for 90 days to encourage negotiations with other nations.

“In the end, I think what’s going to happen is, we’re going to have great deals, and by the way, if we don’t reach an agreement with a company or a country, we’ll set the tariff,” Trump said during an Oval Office ceremony. “I’d say over the next couple of weeks, wouldn’t you agree? I think so. Over the next two, three weeks. We’ll set the number.”

If the tariffs are reimposed, it would mark a significant escalation in the global trade war.

The dollar reaches a three-year low.

The stock market has experienced significant fluctuations this week.

Investors began the week with a sharp sell-off on Monday following Trump’s criticisms of Powell. The dollar dropped to a three-year low, and nearly all companies in the Dow and S&P 500 ended the day lower.

Shares made a modest recovery on Tuesday after Treasury Secretary Scott Bessent told investors that the US-China trade war is unsustainable and anticipated that the conflict would de-escalate, according to a source familiar with the matter.

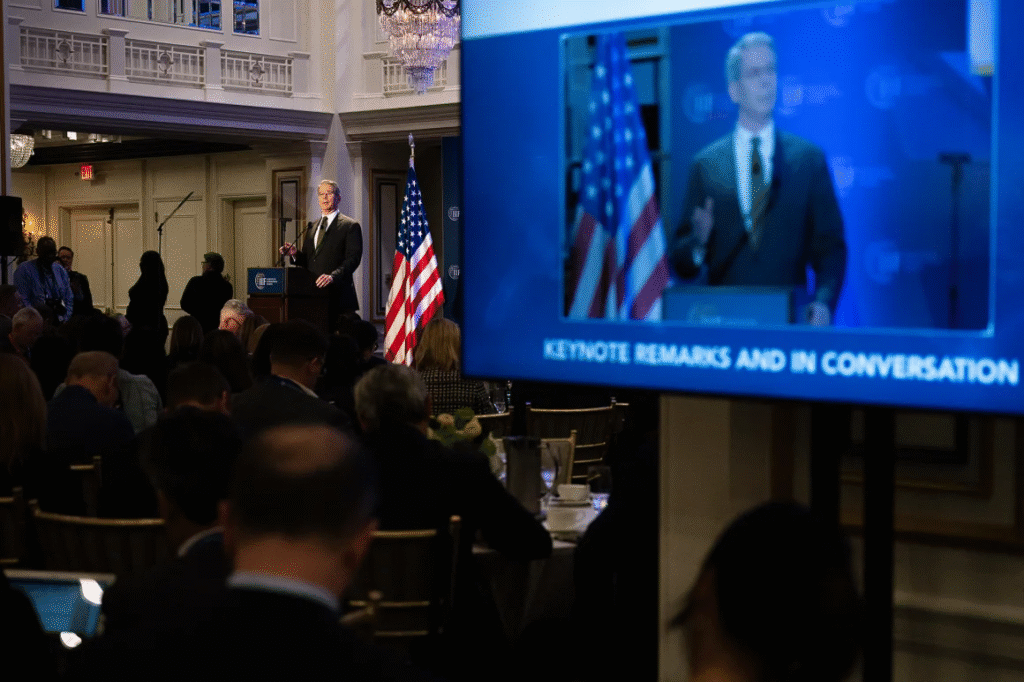

US Treasury Secretary Scott Bessent speaks at the Institute of International Finance’s Global Outlook Forum in Washington, DC, on April 23.

Stocks surged on Wednesday, but Trump still faces a long road to alleviate investors’ concerns. Despite the two-day rally, the S&P 500 has lost $6.5 trillion in market value since its peak in February, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

At the same time, US crude oil prices have dropped as investors worry that a recession could reduce demand. Additionally, US Treasury yields, which move inversely to prices, have risen significantly in recent weeks.

Concerning reports

The IMF issued a serious warning about the global economy and US prosperity in a report on Tuesday.

“We are entering a new era as the global economic system that has functioned for the past 80 years is being reset,” the IMF stated, forecasting a sharp slowdown in economic growth, especially in the United States, along with a resurgence of US inflation.

South Korea’s Customs Service also reported a 5.2% decline in exports during the first 20 days of April compared to the same period last year, signaling the direction of global trade under Trump’s tariff policies.

A specialist operates on the floor of the New York Stock Exchange on April 21.

Billionaires are expressing their views.

Billionaires are increasingly speaking out about the economic impact of Trump’s tariffs.

Ken Griffin, CEO of hedge fund Citadel and a supporter of the president, stated on Wednesday that tariffs are damaging America’s global standing.

“The United States was more than just a nation. It’s a brand. It’s a universal brand, whether it’s our culture, our financial strength, our military strength,” Griffin said at the Semafor World Economy Summit in Washington. “And we’re eroding that brand right now.”

Griffin adds his voice to a growing number of affluent business leaders diverging from the president. Last week, Ray Dalio, founder of Bridgewater Associates, one of the world’s largest hedge funds, remarked that Trump’s tariffs have brought America closer to a recession—or possibly something worse.