For years, inflation has been the primary concern for the American economy. However, a new issue is now emerging as a serious threat: unemployment.

As inflation gradually eases, warning signs are appearing in the still-robust job market. The Federal Reserve now faces the risk of maintaining high interest rates for too long.

Consequently, some economists are urging the Fed to slow down its fight against inflation to prevent high interest rates from pushing the US economy into a recession.

“It’s time to cut rates,” stated Joe Brusuelas, chief economist at RSM. “Inflation is no longer the primary concern. The risks are gradually shifting towards higher unemployment.”

Mark Zandi, chief economist at Moody’s Analytics, noted that the job market is struggling under the burden of high borrowing costs.

“The greatest danger is a policy error: the Fed maintaining rates too high for too long,” Zandi told CNN. “Currently, the Fed indicates a possible rate cut in September, which is acceptable. However, any delay beyond that might be excessive.”

Even Fed Chair Jerome Powell is recognizing a notable shift in the risk landscape.

“Elevated inflation is not the only risk we face,” Powell informed lawmakers on Tuesday, highlighting the easing inflation and the “cooling” job market.

“The job market could be shifting.”

To clarify, the job market is not collapsing.

Jobs are still being generated at a robust rate, surpassing expectations from just a year ago.

However, subtle signs of strain are starting to appear.

While the unemployment rate remains historically low, it has steadily increased for three consecutive months—a signal that “the labor market may be turning,” as noted by economists at KPMG.

Hiring has slowed in the leisure and hospitality sector, which relies heavily on consumer spending. The rate at which workers are quitting their jobs has significantly decreased, as has the rate of new hires.

Fed Chair Jerome Powell highlighted these trends, telling lawmakers that recent indicators “send a pretty clear signal that labor market conditions have cooled considerably” from two years ago.

“This is no longer an overheated economy,” Powell stated.

This outcome aligns with the Fed’s goals when it initiated its significant rate-hiking campaign.

In 2022, the concern was that the job market was so hot it would exacerbate already high inflation, potentially forcing the Fed to induce a recession to control soaring prices.

Now, overheated inflation and an exceptionally strong job market are no longer seen as major issues.

Delaying too much?

The current concern is that the Fed might be applying anti-inflation measures to an economy that no longer requires them. This could cause a cooling job market to freeze, leading to job losses.

In June, the job market added 206,000 positions, according to the latest government data released on Friday. The Fed Chair described the job market as “balanced,” neither too hot nor too cold.

“A balanced labor market with overly restrictive Fed rates will not stay balanced for long,” Brusuelas said. “This means higher unemployment.”

Brusuelas clarified that while unemployment might not skyrocket, an early recession could occur if the Fed delays cutting rates. In a Monday report, KPMG senior economist Ken Kim noted that the unemployment rate is close to triggering the Sahm Rule, which indicates a recession has started when the three-month moving average of the unemployment rate rises by 0.5 percentage points or more above the three-month average.

Kim also highlighted that the services sector, a key driver of US economic growth, is showing signs of weakness.

“No longer is inflation the predominant concern,” Kim wrote. “Equally worrying for the Fed should be the potential for a sharper deterioration in the labor market and economic activity. A soft landing is the goal, but a hard landing is emerging as a tail risk.”

Inflation hasn’t disappeared.

The high cost of living remains a significant concern for Americans.

Although inflation has slowed considerably from 9% in June 2022, the cumulative effect of over two years of sharp price increases is still felt. Americans are paying significantly more for groceries, rent, and insurance than they did before Covid-19.

Moreover, there are still risks related to inflation.

The ongoing conflict in the Middle East poses a potential threat to energy production in the region, and the Russia-Ukraine war has seen drone attacks on oil refineries deep inside Russia.

The upcoming US election also adds substantial uncertainty and complications.

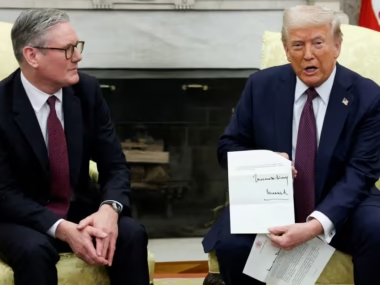

Some mainstream economists worry that former President Donald Trump’s economic policies—tax cuts, immigration crackdowns, and tariff hikes—could “reignite” inflation.

Additionally, cutting rates just before the US election could put the Fed in a politically sensitive position, a scenario it wants to avoid, according to Zandi, the Moody’s economist.

Drawing lessons from past experiences

If the Fed cuts rates prematurely, it could stimulate demand from both consumers and businesses, potentially exacerbating inflationary pressures and worsening the situation.

Powell and his colleagues are grappling with a challenging decision and are keen to avoid repeating past mistakes.

In the 1970s, the Fed initially raised rates sharply but then lowered them before effectively curbing inflation. This led to a resurgence of inflation, forcing the Fed to take more aggressive measures.

More recently, under Powell’s leadership, the Fed was criticized for being slow to address inflation, as officials initially believed it was “transitory” and would naturally subside.

“They have PTSD from previous experiences,” remarked Zandi. “They were slow to raise rates initially, and now they face the risk of maintaining rates too high for too long.”

The Fed is navigating a delicate balance, aiming to appropriately manage inflation without stifling economic growth, learning from historical missteps to make more informed policy decisions.