In the third quarter of the year, the American economy expanded at a rate that exceeded projections, boosted by a strong job market and increased consumer spending.

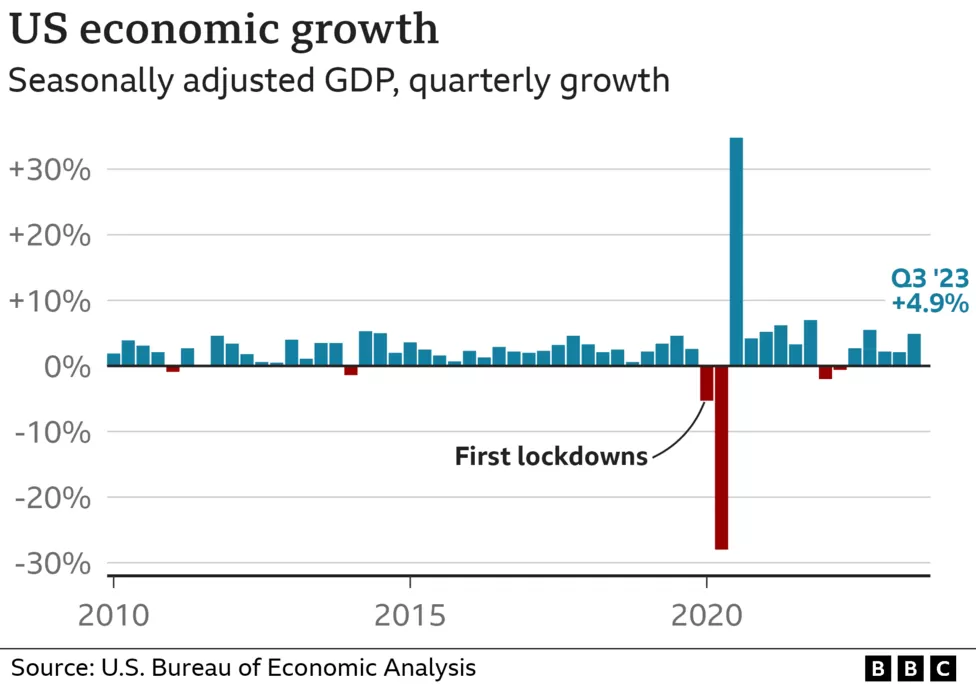

The US economy expanded at an annual rate of 4.9% during the July to September period, according to the initial government estimate. This marked the most significant increase since the last quarter of 2021. Despite the Federal Reserve’s efforts to curb spending through higher interest rates, consumers continued to spend generously.

Analysts had anticipated a 4.5% growth for the economy in the third quarter of this year. However, a robust job market enabled consumers to negotiate higher wages and continue their spending on activities such as concerts, movies, and holidays throughout the summer. Consumer spending, which constitutes over two-thirds of economic activity in the US, was the primary driver of this growth.

This latest figure represents a substantial jump from the 2.1% growth observed in the three months leading up to July. The US Bureau of Economic Analysis, in a statement, attributed this increase to “accelerations in consumer spending, private inventory investment, and federal government spending,” among other contributing factors.

This development raises doubts about previous forecasts that the world’s largest economy could potentially slip into a recession. The most recent data emerges just before a crucial meeting of the US Federal Reserve, during which it will determine whether to once again increase interest rates next week.

Some economists have expressed concerns that the central bank’s decision to raise rates to a 22-year high in an effort to bring inflation closer to a 2% target could trigger an economic downturn. Raising interest rates is a primary tool employed by central banks to combat inflation. By making borrowing more costly, the idea is that consumers will reduce their spending, resulting in a slower increase in prices.

Thus far, the largest global economy has managed to defy the most pessimistic predictions. However, Nationwide’s chief economist, Kathy Bostjancic, anticipates that consumers are using up the “remaining portion of pandemic-related savings” and expects that growth will decelerate in the final quarter of 2023. Ms. Bostjancic has conveyed to the Agence France-Presse news agency that the Federal Reserve might perceive the need for further rate hikes as it grapples with persistent inflation.

In a separate update provided on Thursday, the US Labor Department reported that the number of individuals filing for unemployment benefits remains at a low level. However, as we move into the final quarter of the year, several factors may hinder economic growth. This includes strikes by the United Auto Workers and the resumption of student loan repayments by millions of Americans, placing added pressure on their budgets.

On the other side of the Atlantic, the European Central Bank (ECB) opted to keep interest rates unchanged on Thursday as the impact of higher borrowing costs continues to unfold. The ECB initiated rate hikes in July 2022 in response to rapidly escalating prices. After ten consecutive rate increases, inflation in the eurozone, which had reached its peak at 10.6% in October 2022, has been steadily decreasing, reaching 4.3% in September. Although this still indicates rising prices, the ECB has asserted that borrowing costs are now sufficiently high, and the consequences of previous rate hikes will persist.

In a statement, the ECB’s governing council noted that inflation is still expected to remain “too high for too long,” but they insisted that the current interest rates, if maintained over an extended period, would significantly contribute to achieving their 2% target.

Analysts have pointed out that, despite lingering global economic uncertainties related to the Middle East and Ukraine, the focus is shifting towards the possibility of interest rate cuts, given the current stagnation in the Euro area economy.