Former President Donald Trump’s tough tariff strategy was expected to weigh on the U.S. economy’s performance in the first quarter, as businesses rushed to import goods ahead of the higher tariffs. What many didn’t foresee, however, was how much worse the economy would have looked without that last-minute stockpiling.

According to Ryan Young, a senior economist at the libertarian-leaning Competitive Enterprise Institute, the temporary boost from stockpiling is misleading: “It’s lifting the economy now, but spending will drop later.”

Commerce Department data shows GDP shrank at an annual rate of -0.3% in Q1, a sharp fall from the previous 2.4% pace. This slump sent stocks lower, sparked fears of a recession, and pushed consumer confidence to its lowest point in 13 years.

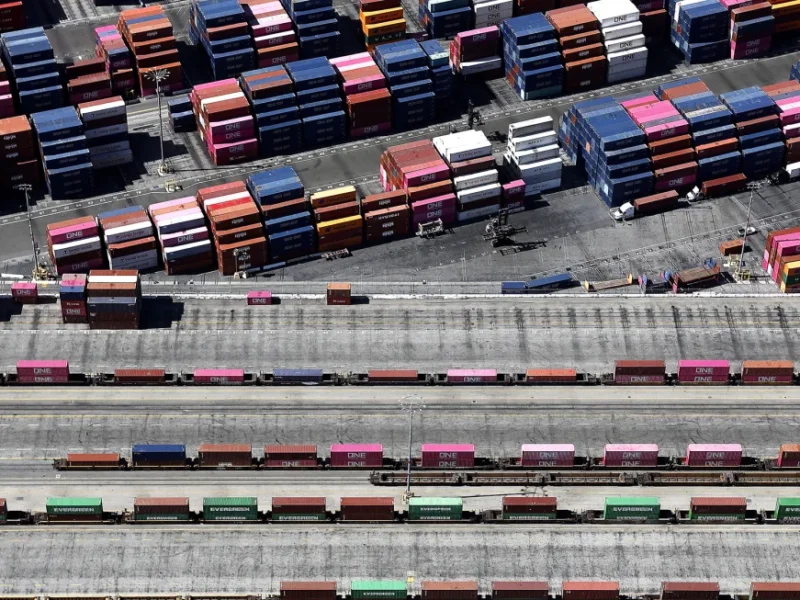

The root of this downturn was a rush to beat Trump’s new tariffs, which led to a 51% spike in goods imports — the fastest since 2020’s pandemic recovery. Without that surge, GDP numbers would have looked even worse.

Trump had clearly signaled a broad increase in tariffs starting April 2 — dubbed “Liberation Day” — prompting businesses to stock up and consumers to accelerate major purchases to avoid future costs.

Though increased imports typically drag down GDP, they also contributed to a notable 22% jump in business investment. This was enough for White House trade adviser Peter Navarro to call the GDP figures “the best negative print” he’d ever seen, although much of that investment was simply inventory buildup.

Consumer spending also rose 1.8% last quarter, but again, this was tied to early purchases before tariffs hit.

Young warned this artificial boost would fade fast: “Stockpiling is making the economy look better than it is — but things could slow down significantly afterward.”

Gregory Daco, chief economist at Ernst & Young, echoed this concern, calling it a “pull-forward in demand” — often followed by a sharp downturn. He predicts Q2 could see serious declines in consumer spending, investment, and inventory buildup, all dragging growth down further.

Not Everyone is on the Same Page

Some economists took a more optimistic view of Wednesday’s GDP figures.

Ernie Tedeschi, director of economics at Yale’s Budget Lab and former Biden administration economist, commented on X that the report reflected a healthy economy bracing for, but not yet affected by, tariffs.

Brian Rose, senior U.S. economist at UBS, shared a similar view. He saw the data as evidence that the broader business cycle remains strong and said he wasn’t overly concerned about the negative GDP figure, noting that a similar contraction in early 2022 was followed by a quick rebound.

Still, Rose warned that the second quarter might not show the same resilience, as the impact of Trump’s tariffs—now the highest among developed nations—starts to weigh more heavily.