Last year marked a breakthrough period for artificial intelligence, and among all companies, chipmaker Nvidia reaped significant benefits from this trend.

According to earnings released on Wednesday, Nvidia’s profits surged to nearly $12.3 billion in the three months ending January 28, a substantial increase from $1.4 billion in the same quarter of the previous year. This impressive growth of 769% year-over-year exceeded even the optimistic expectations of Wall Street analysts. Moreover, Nvidia’s full-year profits soared by over 580% compared to the previous year.

Nvidia’s fourth-quarter revenue also experienced substantial gains of 265% year-over-year, surpassing analyst projections. The company continues to capitalize on the wave of substantial AI investment, with CEO Jensen Huang noting that demand for Nvidia’s products is rapidly increasing across various companies, industries, and nations. Huang likened the widespread adoption of AI technology to the onset of a new industrial revolution.

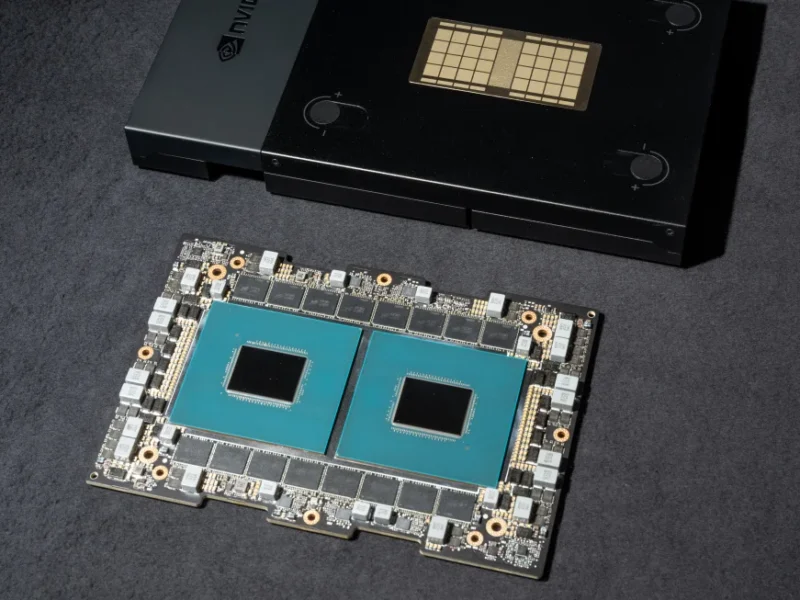

Nvidia plays a pivotal role in the burgeoning AI space, particularly in producing processors that power artificial intelligence systems, including generative AI technology. The company commands approximately 70% of AI semiconductor sales, despite efforts by other tech giants like Meta, Amazon, IBM, and Microsoft to develop their own chips.

Sales from Nvidia’s core data center business soared by 409% year-over-year to a record $18.4 billion in the fourth quarter, driven by partnerships with major infrastructure companies such as Google, Amazon, and Cisco.

However, Nvidia’s soaring stock price, which grew by around 230% in 2023, underscores its significant importance in the broader market. Goldman Sachs analysts went as far as calling Nvidia “the most important stock on planet earth.” Despite this, concerns linger about potential long-term challenges, including US restrictions on exports of advanced AI chips to China, which could impact Nvidia’s access to a crucial and rapidly expanding market.

Nevertheless, Nvidia remains optimistic about its future prospects, with strong demand for its advanced AI chips persisting across various industries. The company anticipates revenue for the current quarter to reach around $24 billion, reflecting a 233% increase from the year-ago quarter and surpassing Wall Street’s expectations.

Nvidia’s shares surged nearly 7% in after-hours trading following Wednesday’s earnings report, indicating continued confidence in the company’s growth trajectory despite potential challenges on the horizon.