Nvidia, the top producer of AI chips, recently reported exceptional earnings with a 122% increase in sales for the second quarter and a doubling of profits. The outlook for the current quarter remains strong.

Despite these impressive results, Nvidia’s shares (NVDA) fell by 7% following the earnings report, and the decline persisted the next day. For a stock that has risen over 150% this year, this drop is relatively minor.

This dip reflects more about Wall Street’s shifting sentiment than about Nvidia itself.

Over the past 18 months, Wall Street has been fervently investing in AI, driven by the hype around its potential. Nvidia has been a major beneficiary, with its stock surging around 3,000% over the past five years and achieving a $3 trillion valuation, placing it among top tech giants like Apple and Microsoft.

Nvidia’s quarterly earnings have become highly anticipated events, often compared to major entertainment spectacles, due to its significant role in the AI sector. The company has consistently exceeded expectations, setting a high bar for itself.

However, this time, while Nvidia did surpass expectations, it did so in a manner that felt somewhat predictable. The excitement was dampened, akin to attending a highly anticipated show only to find that the performance, though excellent, lacked the original spark. This sense of anticlimax, along with other factors, contributed to the cautious reaction from investors.

ROI on AI?

As the initial excitement around AI begins to wane, Wall Street is becoming more realistic about the technology’s true value and its revenue-generating potential.

As Clare Duffy noted earlier this month, despite the substantial investments in AI by major tech companies, tangible results remain limited, and investors are growing impatient. While tools like ChatGPT and Google Gemini are impressive, they haven’t proven to be the revolutionary breakthroughs they were once hyped as. Many users are seeking AI solutions to simplify routine tasks, yet tech companies often focus on automating more creative and personal aspects of life, such as writing or art, which can seem less practical.

For Nvidia investors, there’s both good and bad news.

Some Wall Street observers worry that the AI frenzy might be a bubble poised to burst. However, Nvidia is not a startup chasing AI hype but a well-established player providing essential technology. If the AI boom is likened to a gold rush, Nvidia is akin to the supplier of the necessary tools. Its products, highly valued even before the current AI surge, will continue to be relevant beyond the AI hype cycle, regardless of how AI evolves.

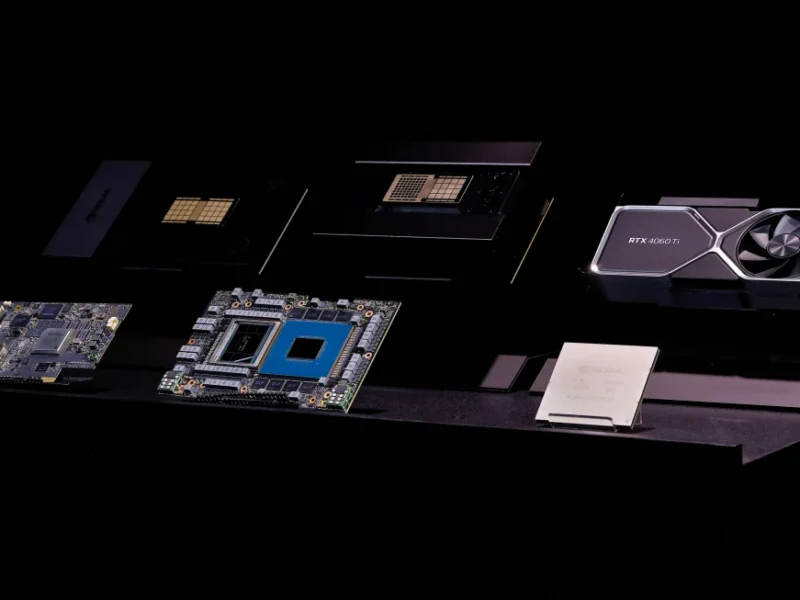

Nvidia CEO Jensen Huang highlighted that the company’s chips are crucial not only for AI chatbots but also for advertising systems, search engines, robotics, and recommendation algorithms, with its data center business generating nearly 90% of its revenue.

The potential downside for Nvidia is that while its hardware is complex and difficult to replicate, making it indispensable to tech giants like Google and Amazon, these same companies might eventually become competitors. Many are investing in developing their own AI chips, which could pose a threat to Nvidia’s dominant position in the future.