Sam Altman, the CEO of OpenAI, also chairs Oklo, a company focused on advancing nuclear power technology. This initiative is seen as vital by tech leaders, including Altman, to support the growing energy needs of AI development. As data centers expand to support the increasing demand for AI, energy consumption could surpass available supply, creating challenges for tech companies aiming to revolutionize daily life through AI.

While nuclear energy is being promoted as a key solution for a sustainable future, some experts question whether the benefits will extend beyond the tech sector to the public. Sharon Squassoni, a nuclear policy researcher, notes that while tech companies are prioritizing their own needs, it’s uncertain how much these nuclear ventures will serve broader society.

Electricity demand from U.S. data centers has surged 50% since 2020, now accounting for 4% of the nation’s energy use, a figure that may reach 9% by 2030. Overall power demand in the U.S. is expected to rise 13% to 15% annually until 2030, making electricity a potentially scarcer resource. This surge in demand threatens the sustainability goals of tech giants.

Nuclear power’s reliability, compared to renewable sources like solar and wind, is a key advantage for data centers, which require continuous energy. Companies like Microsoft, Amazon, and Meta are securing future nuclear power deals to ensure consistent electricity for their operations.

Altman’s involvement in nuclear energy extends beyond Oklo. He has invested in Helion Energy, another nuclear startup. Other tech leaders, including Facebook’s co-founder Dustin Moskovitz, LinkedIn’s Reid Hoffman, and Peter Thiel’s Mithril Capital, have also supported Helion Energy.

Altman isn’t alone in the push for nuclear. Bill Gates’ TerraPower is developing a reactor in Wyoming, and Google, Amazon, and Jeff Bezos have all backed various nuclear startups, with Amazon anchoring a $500 million round for X-energy. Thiel’s Mithril Capital holds a significant stake in Oklo, and investor Cathie Wood’s Ark Invest also backed the company this year.

The push for nuclear

Lawmakers are increasingly supporting the expansion of nuclear power. In July, President Joe Biden signed the Advance Act into law, which aims to streamline the approval and construction of new nuclear reactors, with backing from both parties. Additionally, at this year’s COP28 climate talks, the U.S. joined over 20 other nations in a pledge to triple global nuclear energy capacity by 2050. Some experts view investments from the tech industry as key to advancing nuclear power, a costly but clean energy solution that could help tackle climate change.

“As we see it, those driving AI today are the ones with the financial resources,” said Erickson.

Megan Wilson, Chief Strategy Officer at General Fusion, explained to CNN that the growing interest from tech companies in nuclear energy reflects a widespread understanding that clean, reliable, and affordable baseload power—free from carbon dioxide and methane—is essential.

Although General Fusion is still working to prove its technology, Wilson noted that fusion is expected to be safer than fission, as it involves combining atoms, making it difficult to initiate and easy to stop. The company anticipates that its future plants will have radiation profiles similar to those of hospitals using medical isotopes or cancer treatment wards.

However, some experts are concerned about significant investments in nuclear power by tech industry leaders known for resisting regulations that could slow their progress, even when meant to enhance safety.

“The issue is that Silicon Valley giants have the power to push through many of their demands, and their primary approach is to oppose any regulation that could impede their plans,” said Edwin Lyman, Director of Nuclear Power Safety at the Union of Concerned Scientists. “I’m worried that crucial safety and security regulations might be compromised.”

A spokesperson from TerraPower told CNN, “It’s clear that the world requires more carbon-free, reliable power, and advanced nuclear energy plays a crucial role in helping both public and private sectors meet decarbonization targets as energy demand surges. Studies indicate that achieving net-zero goals won’t be possible without nuclear energy, and those serious about carbon-free targets must plan to integrate it into their energy portfolios.”

Oklo did not respond to requests for comment.

Altman’s Oklo

Oklo, founded in 2013 by two MIT graduates, is working on advanced nuclear reactors designed to “produce abundant, affordable, clean energy at a global scale.” The company’s name is derived from the Oklo region in Gabon, Africa, where scientists discovered the Earth’s only known natural nuclear reactor, dating back around 2 billion years.

The company is developing “fast reactors,” which it claims can generate more power with less fuel, making them smaller and more cost-effective. These reactors could also recycle spent nuclear fuel from other plants. Oklo aims to sell energy from these compact reactors directly to customers, such as data center operators, potentially on-site.

With AI poised to revolutionize technology in the coming decades, Oklo CEO and co-founder Jacob DeWitte emphasized in May that nuclear fission is well-suited for providing reliable, scalable, and clean energy.

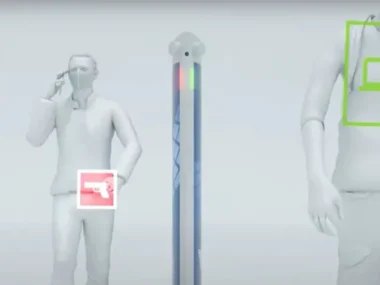

Oklo plans to construct smaller, more efficient nuclear reactors that could be housed in A-frame buildings, potentially located alongside data centers, as depicted in this rendering.

Oklo’s stock has doubled since it went public in May after merging with Altman’s special purpose acquisition company, AltC Acquisition Corp. This strong performance comes amid expectations that AI-driven growth will increase demand for nuclear power, although Oklo is not yet profitable.

Despite this, Oklo claims progress toward its goals. In September, the company received approval to begin site investigations for one of its small reactors in Idaho and has secured several agreements to sell future power to data center operators.

However, as noted by Squassoni, these small modular reactors are still “theoretical” and face a long, costly path before they can actually generate and sell power.

Recent U.S. efforts to develop new nuclear reactors have encountered delays and cost overruns. Additionally, the U.S. faces challenges in securing enough fuel for new reactors due to restrictions on enriched uranium imports from Russia following its war in Ukraine. The U.S. government is now searching its own nuclear stockpile for fuel while working to ramp up domestic enrichment efforts.

Gates’ TerraPower

Gates’ TerraPower began construction in June on its nuclear reactor “demonstration” plant, Natrium, with plans to have it operational by 2030. Currently, construction in Kemmerer, Wyoming, is focused on non-nuclear components as the project awaits full regulatory approval.

TerraPower claims its design is smaller and simpler than conventional nuclear reactors, using sodium for cooling instead of the traditional water-based system. The plant is being built near a coal power plant that is set to retire and will supply power to PacifiCorp, a utility company that has depended on the coal plant.

On January 12, 2022, steam was seen billowing from the stacks at the Naughton Power Plant in Kemmerer, Wyoming. The plant is scheduled to close in 2025, and TerraPower has announced that Kemmerer will host the site of its demonstration nuclear reactor.

Similar to Oklo’s design, TerraPower’s reactors will feature “passive” safety mechanisms, meaning they are engineered to automatically cool down in the event of a malfunction, preventing catastrophic accidents like the 1986 Chernobyl disaster.

Bill Gates has stated that he founded and invested over $1 billion in TerraPower because he believes expanding nuclear energy is crucial to addressing climate change.

“This is a major step toward safe, abundant, zero-carbon energy,” Gates remarked during the Wyoming plant’s groundbreaking ceremony in June. “It’s vital for the future of this country that projects like this succeed.”

However, TerraPower and other nuclear startups still face the challenge of convincing the public that their next-generation reactor designs are not only viable but also safe.

“The industry has been advocating for loosening regulations and expediting processes, and the Trump administration will likely push to speed things up and reduce some regulations,” said Squassoni.

In a June NPR interview, Gates addressed nuclear safety concerns, expressing that the company welcomes regulatory scrutiny. “The Nuclear Regulatory Commission is the best in the world, and they’ll question us and challenge us. And, you know, that’s fantastic,” he said.