The company warns that consumer confidence may decline further as several countries face potential recessions.

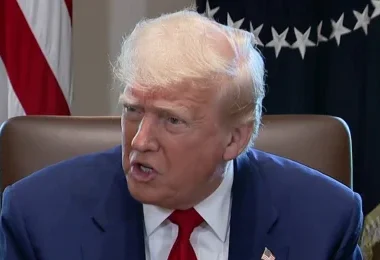

Shares in Primark’s parent company dropped after the budget fashion retailer reported a steep fall in UK sales and a loss in market share, as the firm cautioned that global consumer confidence could weaken further due to trade tensions linked to Donald Trump’s policies.

Associated British Foods (ABF), which also owns brands like Ryvita and Kingsmill, stated that US trade actions could push several countries toward recession.

ABF noted, “Market sentiment is unlikely to recover given ongoing volatility caused by recent US tariff measures, China’s retaliations, and fears of expanding trade wars.” The company warned that consumer confidence could deteriorate further as more countries, including the US, face rising recession risks and personal debt burdens.

Primark’s UK and Ireland sales declined 6% in the 24 weeks leading up to 1 March, despite solid Christmas trading. Shares initially dropped over 9% and later settled at a 6.5% decline.

The company also addressed leadership changes, as CEO Paul Marchant resigned last month following a complaint about his behavior. He acknowledged poor judgment, and a replacement is being sought.

ABF blamed the drop in UK clothing demand on subdued consumer sentiment and unseasonably mild autumn weather, which discouraged seasonal shopping. Weak customer spending led to a loss of market share, though signs of recovery have emerged recently.

Primark’s total sales increased 1%, helped by new store openings in the US, Spain, Portugal, France, Italy, and parts of Europe.

Overall, ABF’s revenue fell 2% to £9.5bn, and pre-tax profit dropped 10% to £818m, mainly due to losses in its sugar division.

The company sees opportunity in recent US tariff changes that could shift consumers toward in-store shopping. ABF plans to expand from 29 to 60 Primark stores in the US by 2026. CEO George Weston believes changes to the “de minimis” import rule, which previously exempted shipments under $800 from tariffs, may drive US shoppers to physical stores like Primark as competitors raise prices.

Separately, ABF warned it might shut its UK bioethanol plant, Vivergo, unless regulations are revised. The plant has cut output due to low ethanol prices and mounting losses. Discussions with the government are ongoing, but the company said closure is a possibility if regulatory changes aren’t made.

Aarin Chiekrie of Hargreaves Lansdown commented that while Primark’s revenue remains sluggish, favorable weather could boost footfall. Still, the brand is increasingly dependent on international markets to sustain growth.