Investor concerns about heightened tensions in the Middle East caused unease on Monday, resulting in significant market fluctuations. The Dow Jones Industrial Average experienced a 600-point swing during the day, ultimately closing around 250 points lower. This follows a nearly 500-point drop on Friday.

The potential actions of Israel in response to Iran’s weekend attack, the ongoing conflict between Russia and Ukraine, and the persisting trade disputes between China and the United States are all contributing to investor anxiety. These geopolitical uncertainties, coupled with existing worries about inflation, are keeping markets on edge.

Jamie Dimon, CEO of JPMorgan Chase, emphasized on Friday that geopolitics pose the most significant threat to the “future of the free world,” particularly concerning the impact on the global economy if oil and gas prices rise excessively.

This week, investors will closely monitor statements from policymakers and economists at the IMF-World Bank spring meetings in Washington, DC. The IMF’s release of its latest World Economic Outlook and remarks from US Federal Reserve Chair Jerome Powell and others will be particularly scrutinized.

Uncertainty surrounding geopolitical tensions is also affecting oil and gold markets. Any escalation of conflicts could lead to increased oil prices and a rise in demand for gold as a safe-haven asset.

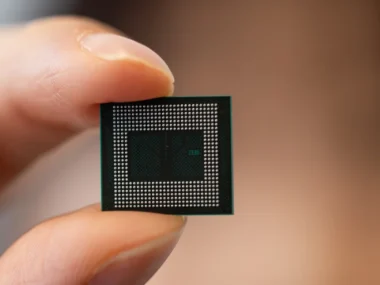

The semiconductor industry is also under scrutiny due to escalating tensions between the US and China. Shares of chipmakers like Nvidia and AMD have experienced fluctuations amid concerns over export controls and geopolitical uncertainties impacting their outlook.

Research from the Federal Reserve Bank of New York indicates that export controls limiting chip shipments to China have negatively impacted US companies and suppliers, leading to significant market capitalization losses and declines in revenue and profits.

Boeing is affirming the safety of its aircraft prior to a whistleblower hearing.

Boeing took swift action on Monday to address safety and quality concerns surrounding its aircraft in anticipation of a whistleblower hearing scheduled in the Senate on Wednesday, as reported by Chris Isidore and Pete Muntean.

A briefing was organized for journalists following reports last week indicating that the Federal Aviation Administration is investigating allegations made by Boeing engineer Sam Salehpour. Salehpour claimed that Boeing had cut corners during the manufacturing process of its 777 and 787 Dreamliner jets, potentially increasing the risk of catastrophic failure as the aircraft age.

Salehpour is expected to be the primary witness at the Senate permanent subcommittee on investigations hearing on Wednesday. Boeing, which has faced a tarnished reputation regarding safety and engineering quality in recent times, held the briefing on Monday in an attempt to address Salehpour’s concerns proactively. However, company executives stated they would not directly comment on his allegations.

Boeing has been under scrutiny for over five years regarding the safety and quality of its commercial jets, particularly following two fatal crashes involving the 737 Max model in 2018 and 2019, which resulted in the deaths of 346 people and a 20-month grounding of the aircraft.

Earlier this year, Boeing faced renewed attention after a door plug blew out during a 737 Max flight operated by Alaska Airlines on January 5, causing significant damage to the aircraft’s side. This incident triggered investigations and raised allegations that some Boeing employees may have been hesitant to raise safety concerns about the planes they were involved in building or inspecting, due to fears of retaliation.

Retail sales in the United States increased in March for the second consecutive month.

According to my colleague Bryan Mena’s report, spending at US retailers continued its upward trend in March, marking the second consecutive month of growth. This highlights the resilience of the US consumer, buoyed by a robust job market.

The Commerce Department disclosed that retail sales expanded by 0.7% in March compared to the previous month. Although this growth rate was slightly slower than February’s revised increase of 0.9%, it surpassed economists’ expectations of a 0.4% rise, as per a FactSet survey. It’s important to note that these figures are adjusted for seasonal variations but not for inflation.

March marked the seventh month out of the last ten where retail spending has seen an increase.

Claire Tassin, an analyst specializing in retail and e-commerce at Morning Consult, commented on Monday that the latest retail sales figures reflect robust consumer spending as the first quarter of 2024 concludes. Tassin also noted that promotional efforts by e-commerce giants like Amazon contributed to the uptick in online sales during March.