Nvidia exceeded Wall Street’s earnings forecasts once again in its report on Wednesday. However, for a company that has experienced extraordinary growth over the past two years, simply meeting high expectations may no longer suffice to captivate investors.

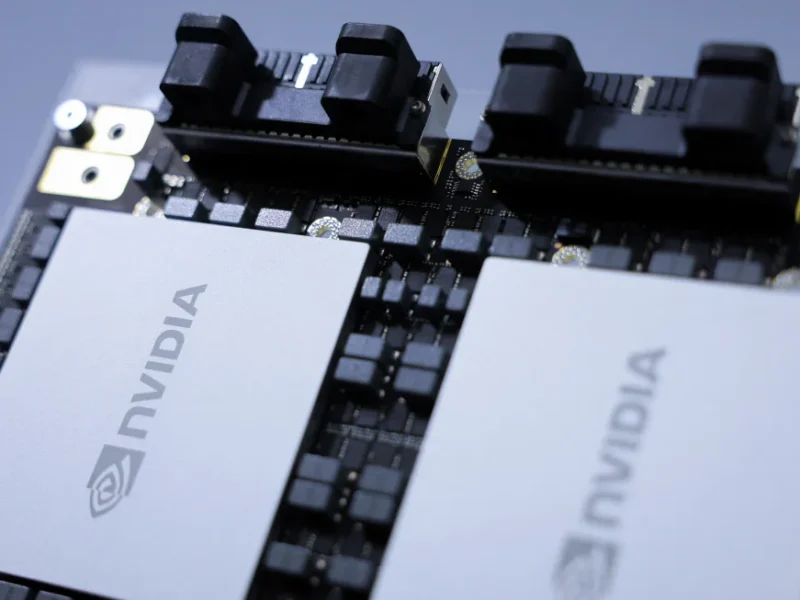

The AI chip manufacturer, which has significantly contributed to the market’s surge this year, announced over $30 billion in sales for its fiscal second quarter—an impressive 122% increase from the same quarter last year and surpassing the $28.7 billion anticipated by analysts. Profits for the quarter more than doubled to $16.6 billion, exceeding the $15 billion forecast.

The company also provided slightly better-than-expected sales guidance for the current quarter, which was another positive sign for investors. Nonetheless, Nvidia’s shares fell up to 5% in after-hours trading following the earnings report.

Nvidia’s leading AI processors have driven a surge in AI technologies and spurred an AI boom on Wall Street. The company’s stock has soared 154% this year and over 3,000% in the past five years, with its market capitalization now exceeding $3 trillion—a milestone achieved by only three U.S. companies.

Despite these achievements, questions about the sustainability of the AI hype cycle have emerged. Uncertainty surrounds how soon and to what extent the technology will impact tech giants’ financial results. Additionally, rapid growth is challenging to sustain indefinitely. Although Nvidia surpassed Wall Street’s expectations, investors were apparently disappointed that the results weren’t more impressive. Concerns about potential delays in Nvidia’s latest AI chips, Blackwell, added to the pre-earnings anxieties, though executives assured that revenue from Blackwell is expected within this fiscal year.

Nvidia CEO Jensen Huang mentioned that demand for Blackwell significantly exceeds supply, but assured that substantial supply will be available by Q4. The company’s share trajectory influences the broader market due to its approximately 7% weighting in the S&P 500.

Nvidia’s earnings reports have become highly significant in financial news, according to Bespoke Investment Group. Despite investor nervousness, the company’s business momentum remains strong. The data center segment, a major driver of Nvidia’s success, generated nearly $26.3 billion in sales, accounting for 87% of total revenue.

Big Tech’s aggressive AI investments continue to drive substantial demand for Nvidia’s chips, even as these companies invest in developing their own silicon. In recent earnings reports, Google, Microsoft, and Meta Platforms indicated plans to increase AI spending. Meta expects to spend between $37 billion and $40 billion on capital expenditures this year, Microsoft anticipates higher spending in fiscal 2025, and Google projected capital expenditures “at or above” $12 billion per quarter this year.

Despite worries about Blackwell delays, Third Bridge estimates that 60-70% of AI model training at hyperscalers like Microsoft and Google will use Nvidia’s new chips by the end of next year.

Nvidia CEO Jensen Huang defended the company’s prospects during a call with analysts, emphasizing that Nvidia’s chips are essential not only for AI chatbots but also for ad targeting, search engines, robotics, and recommendation systems. Huang highlighted that Nvidia’s chips provide immediate returns for investors by processing data more efficiently, ultimately saving clients money. He predicted that GPUs, the type of chip Nvidia specializes in, will become a staple in every data center.

Overall, even if the current stock hype diminishes, Nvidia’s solid fundamentals are expected to sustain the company’s strong performance in the near future.