The distinction between a revolution and a market bubble often boils down to time and patience, qualities that are frequently scarce on Wall Street. As the artificial intelligence (AI) boom expands its reach into various aspects of workers’ lives and propels stock prices to unprecedented heights, some investors are grappling with concerns about the authenticity of the AI revolution and the potential consequences if it turns out to be less substantial than anticipated.

In recent times, shares of Nvidia have surged dramatically, displaying a seemingly relentless upward trajectory. Over the past year, the California-based chipmaker’s stock has soared by approximately 240%, a trend echoed by other players in the industry. AMD has seen a 126.5% increase in its stock value over the same period, while Taiwan Semiconductor Manufacturing Co has experienced a nearly 50% surge.

The “Magnificent Seven” tech giants — Apple, Microsoft, Nvidia, Amazon, Google, Meta, and Tesla — which dominate the S&P 500, have also reaped significant benefits from the excitement surrounding AI. Collectively, their stock prices have surged by approximately 55% over the past year.

Moreover, major corporations are redirecting their resources to make substantial investments in AI technology, sometimes leading to layoffs as they anticipate heightened productivity through automation.

JPMorgan Chase CEO Jamie Dimon, known for his skepticism towards new technologies and trends, emphasized the legitimacy of AI during an interview with CNBC. Dimon highlighted that approximately 200 individuals at JPMorgan are dedicated to researching generative AI, underscoring the seriousness with which the technology is being pursued. Contrasting the current AI landscape with the hype surrounding the internet bubble of the past, Dimon asserted that AI is not mere speculation but a tangible reality. He emphasized that while the adoption of AI may vary among different entities, its potential to handle a wide range of tasks is substantial and undeniable.

Not everyone is convinced of the current market trends. Torsten Slok, chief economist at Apollo Global Management, pointed out in a note to investors that the top 10 companies in the S&P 500 are more overvalued today than they were during the tech bubble of the mid-1990s, citing their price-to-earnings ratios.

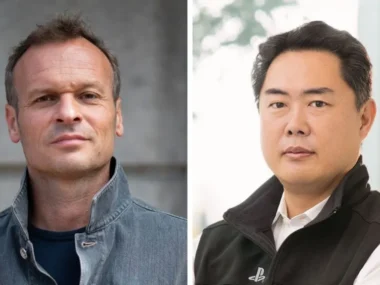

The remarkable growth of these companies has created a resilient stock market, with adverse events seemingly having little impact, as noted by Yung-Yu Ma, chief investment officer at BMO Wealth Management. He highlighted the prevailing narrative that AI can drive both spending and productivity, which has captured the market’s attention.

However, Ma cautioned against the singular focus on AI, expressing concern that the current enthusiasm may be overstated. He drew parallels to the tech boom of the mid-1990s when equities were propelled for years despite relatively high interest rates, driven by expectations of a productivity boom that didn’t fully materialize.

Delving deeper into the issue, some shareholders are apprehensive about Big Tech’s heavy investment in AI. Apple, for instance, is reportedly planning to allocate $1 billion annually towards generative AI. Two significant Apple investors, Norges Bank Investment Management and Legal & General, have indicated their support for a resolution to be voted on at the company’s annual shareholder meeting. This resolution seeks to compel Apple to disclose and report on AI-related risks and adopt ethical guidelines regarding AI technology usage. The proposal, introduced by the union federation AFL-CIO, has faced pushback from Apple, which proposed skipping the vote. However, the SEC disagreed, stating that the proposal transcends ordinary business matters and does not seek to micromanage the company.

Fidelity reports a 41% increase in the number of 401(k) ‘millionaires’ last year.

According to data released on Tuesday, while there has been a significant increase in the number of new 401(k) “millionaires” last year, the overall count remains relatively low.

Thanks to robust performances in both stocks and bonds in 2023, along with consistent savings habits and employer-matched contributions, 401(k) investors saw substantial gains by the end of the year. Fidelity Investments, one of the largest providers of workplace retirement plans covering 23 million 401(k) participants, reported these findings.

The average 401(k) balance surged to $118,600 by the end of the fourth quarter, marking a 14% increase for the year.

Among Generation Xers, the demographic cohort approaching retirement over the next decade, Fidelity observed that the average 401(k) balance exceeded $500,000 for those who had consistently saved for at least 15 years.

Furthermore, Fidelity noted a 20% increase in the number of 401(k) accounts with balances of at least $1 million in the fourth quarter alone, reaching a total of 422,000 accounts. This marked a 41% rise for the entire year, with the average account balance for this group standing at $1,551,300 in the fourth quarter.

While market performance played a significant role in boosting balances, Fidelity emphasized the importance of actual savings habits. Approximately 27% of plan participants actively increased their contribution rate throughout the year. Moreover, 78% of 401(k) savers were contributing at a rate sufficient to receive their employer’s full matching contribution.

The average savings rate last year, combining employee and employer contributions, stood at 13.9%, slightly higher than the 13.7% recorded the previous year.

Beyond Meat’s stock experiences a surge following the CEO’s commitment to significantly reduce costs in 2024.

After announcing plans to streamline operations and reduce costs in its fourth-quarter financial report, Beyond Meat witnessed a remarkable surge in its stock during after-hours trading on Tuesday.

The plant-based meat company, which has faced challenges including declining demand and rising expenses, revealed a turnaround strategy aimed at implementing a “leaner operating structure.” CEO Ethan Brown outlined the company’s intentions to significantly slash operating expenses and cash utilization as part of its 2024 plan.

Despite reporting a 7.8% decline in year-over-year net revenues to $73.7 million, Beyond Meat exceeded Wall Street’s expectations for the quarter, according to Factset data.

Investor confidence soared following the report, with Beyond Meat’s stock surging by more than 70% in after-hours trading on Tuesday, a stark contrast to its over 60% decline over the past year.

During a call with investors, Brown outlined several initiatives aimed at revitalizing the struggling company. Beyond Meat plans to reduce its operating budget by at least $70 million in 2024, with a focus on refining its product portfolio. This includes discontinuing its Beyond Meat jerky line to allocate resources towards products with higher growth potential and profitability.

While details regarding potential layoffs were not specified, the company’s cost-cutting measures suggest a concerted effort to streamline operations and improve financial performance.