Before the “first-in-the-nation” primary elections in New Hampshire, it’s worth noting that the state has generally enjoyed a more favorable economic situation compared to many others across the United States. New Hampshire boasts a low unemployment rate and robust economic growth, but this doesn’t imply that the state is devoid of challenges. Here’s an overview of New Hampshire’s economic status leading up to Tuesday’s elections.

Robust employment situation

New Hampshire possesses a varied array of industries, mirroring the overall diversity found in the United States. However, it has established strong sectors in areas like healthcare, education, and manufacturing. Despite being a state with one of the highest rates of interstate commuting in the nation, primarily due to its proximity to major metropolitan areas such as Boston, New Hampshire maintains an impressively low unemployment rate. In November, it recorded a preliminary jobless rate of just 2.3%, according to data from the Bureau of Labor Statistics.

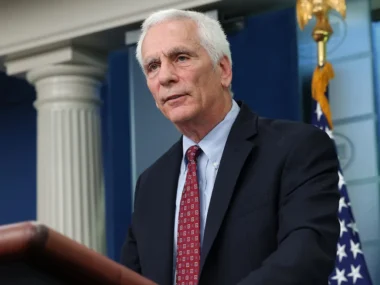

Charlie Dougherty, a senior economist at Wells Fargo specializing in the Northeastern United States, described the situation as a bit of a mixed bag. On the positive side, it signifies a robust labor market where many individuals are gainfully employed, and for those who do experience job displacement, it’s comparatively straightforward to secure new employment.

However, the downside is that businesses face challenges when trying to hire new employees.

Employers are encountering difficulties in their search for workers.

Worker shortages have been a prominent issue during the pandemic recovery throughout the country, with economic growth surpassing businesses’ ability to hire sufficient employees. Several factors have contributed to this tight labor market, including early retirements, COVID-related deaths and health issues, caregiving responsibilities, health and safety concerns, and a growing desire for work-life balance. However, the labor market situation in New Hampshire has been particularly acute.

Charlie Dougherty, the Wells Fargo senior economist, pointed out that New Hampshire faces challenges due to slower population growth. The state has an older demographic, and as more people exit the labor force due to aging, it poses long-term growth challenges. In November, there were 2.1 job openings for every person seeking employment in New Hampshire, according to state-specific data from the Bureau of Labor Statistics (BLS). Nationally, this ratio stands at 1.4, indicating that New Hampshire’s labor market remains more competitive.

While both rates are gradually returning to pre-pandemic levels, New Hampshire still has progress to make. Tight labor markets can contribute to inflation, as the Federal Reserve considers imbalanced labor markets potential drivers of higher wages, which can, in turn, lead to increased prices and sustained inflation.

Moreover, despite New Hampshire’s appeal for businesses and workers due to its lack of income tax and sales tax, the state is grappling with a housing crisis. The challenge isn’t just attracting people; it’s also finding suitable housing options for them, according to Patricia M. Anderson, an economics professor at Dartmouth University.

The affordability of housing is becoming more and more challenging in New Hampshire.

Housing affordability in New Hampshire has deteriorated in recent years due to the combination of rising home prices and higher mortgage rates, making homeownership unattainable for many residents.

According to Charlie Dougherty, this trend is particularly evident in the Northeast, where housing supply constraints contribute to upward price pressure. In towns like Chester, New Hampshire, located approximately 20 minutes from Manchester, home prices have surged over the past year. Patrick Connelly, who runs Field to Fork Farm, an organic farm and event venue in Chester, noted that there is a shortage of rental properties and a backlog of houses waiting to be built, primarily due to the prevailing high-interest rate environment. However, the homes being constructed tend to be in the $700,000-$900,000 range, which is not conducive to addressing the issue of affordable housing.

While New Hampshire is known for not having an income tax and sales tax, it does have the third-highest property taxes in the nation, as per the Tax Foundation’s analysis.

To address the housing affordability challenge, the state has allocated $100 million in federal COVID-19 recovery funds to facilitate the construction of more affordable housing and bolster the workforce.

Devon cattle can be seen grazing on a portion of the 70-acre pasture at the Field to Fork Farm in Chester, New Hampshire.

Travel and tourism

New Hampshire’s significant tourism sector has rebounded in terms of both visitors and revenue following the impact of the Covid-19 pandemic. According to the state’s economist, Brian Gottlob, people were eager to find destinations to visit once pandemic restrictions were lifted. He attributes this recovery to the pent-up desire for travel and highlights that New Hampshire’s effective image creation and marketing efforts played a substantial role in attracting visitors.

On January 17, 2024, skiers had a chilly afternoon enjoying the slopes at Attitash Mountain in Bartlett, New Hampshire.

In 2021, when air travel was still limited due to the pandemic, New Hampshire’s tourism division took the initiative to boost its digital marketing efforts in nearby drivable areas such as Ohio and Washington, D.C., according to Lori Harnois, the director of New Hampshire’s tourism. Presently, the focus of marketing has expanded to include Canada and more extensive regions of New York and Pennsylvania.

During the past summer, approximately 4.5 million visitors contributed $2.3 billion to the state’s economy, marking a 3.3% increase in both visitor numbers and spending compared to the summer of 2022. It’s worth noting that part of the spending increase can be attributed to inflation.

However, despite this recovery, the tourism industry in New Hampshire is still facing a shortfall of approximately 800 to 1,000 jobs compared to its pre-pandemic staffing levels, primarily due to ongoing labor shortages. Tourism, encompassing leisure and hospitality, ranks as New Hampshire’s second-largest employer, trailing only behind the retail sector.

Median income/poverty

In New Hampshire, the average household income surpasses the national average, and a smaller percentage of the state’s population lives in poverty.

According to the Census Bureau, the median household income in New Hampshire for 2022 was slightly below $90,000, in contrast to the national median of just under $75,000.

Additionally, New Hampshire boasts the lowest official poverty rate of any state, standing at 7.2% for 2022, while the national poverty rate is 12.6%, as reported by the bureau’s American Community Survey.

Southeastern New Hampshire, where approximately three-quarters of the state’s residents reside, benefits significantly from its proximity to the Boston metropolitan area, as highlighted by Phil Sletten, the research director at the left-leaning New Hampshire Fiscal Policy Institute. This region boasts the highest median incomes and the lowest poverty rates in the state.

However, other areas of New Hampshire, particularly those in the northernmost and west-central regions, which are primarily rural, face more significant challenges. Their poverty rates, as reported by Sletten, were 11.6% and 11.7%, respectively, during the 2018 to 2022 timeframe, compared to the state’s overall rate of 7.3% during that period.

Furthermore, Sletten pointed out that it’s crucial to consider that New Hampshire is a relatively expensive state to reside in. He noted that while the top-level economic figures may indicate that the state is economically better off compared to many others, without adjusting for the cost of living, it may not truly reflect the overall financial well-being or security of households.

A more optimistic and positive sentiment and perspective.

New Hampshire residents give President Joe Biden somewhat higher marks on his handling of the economy compared to what other surveys have found for the nation at large. Some 42% of New Hampshire residents approved of Biden on the economy, with 55% disapproving, according to a November CNN/University of New Hampshire poll.

New Hampshire’s economy expanded at a 4.5% rate during the third quarter of last year, according to Commerce Department data. That robust rate was close to the national average of 4.9%.

But when it comes to their personal finances, New Hampshire residents are downbeat. Some 46% think their household is worse off financially than a year ago, while only 15% say they are better off, and 39% feel their finances are about the same, according to a December poll from the University of New Hampshire Survey Center.

On the chilly winter evening of January 20, 2024, customers depart from the House of Pizza in the rural northern region of New Hampshire in Colebrook.

There is one positive aspect to note: In 2022, approximately 61% of New Hampshire residents believed their household financial situation had worsened. However, the current percentage, while still high, is “considerably higher” than it was in 2021, as reported by the center.

Sentiments about personal finances vary significantly along party lines. The percentage of Republicans who express a belief that they are worse off financially is close to an all-time high, whereas the percentages among Democrats and Independents who feel this way have seen a significant decline over the past year, according to the center’s findings.

Patrick Connelly remarked that many of his friends and acquaintances seem steadfast in their political choices and believe the economy would have limited influence on their voting decisions. He noted that this sentiment is quite common in New Hampshire, where people often firmly align with their chosen political camps and are less likely to shift their positions.