Factory activity among China’s private firms expanded at the fastest pace in three years, according to a private gauge released Monday, indicating stronger domestic and international demand for Chinese goods.

This finding contrasts with the results of an official government survey released Sunday, which showed a contraction among larger, state-owned manufacturers. This highlights the uneven nature of the recovery in the world’s second-largest economy.

The Caixin manufacturing Purchasing Managers’ Index (PMI) increased to 51.8 in June, up from 51.7 in May, according to a statement from S&P Global, which compiled the survey. These numbers not only exceeded market expectations but also marked the sixth consecutive month of improvement in the index. However, this gauge conflicted with the National Bureau of Statistics (NBS)’s PMI, which remained unchanged from May at 49.5, marking a second consecutive month of contraction.

The PMI is a monthly indicator of economic activity, with a reading above 50 indicating expansion and a reading below 50 indicating contraction.

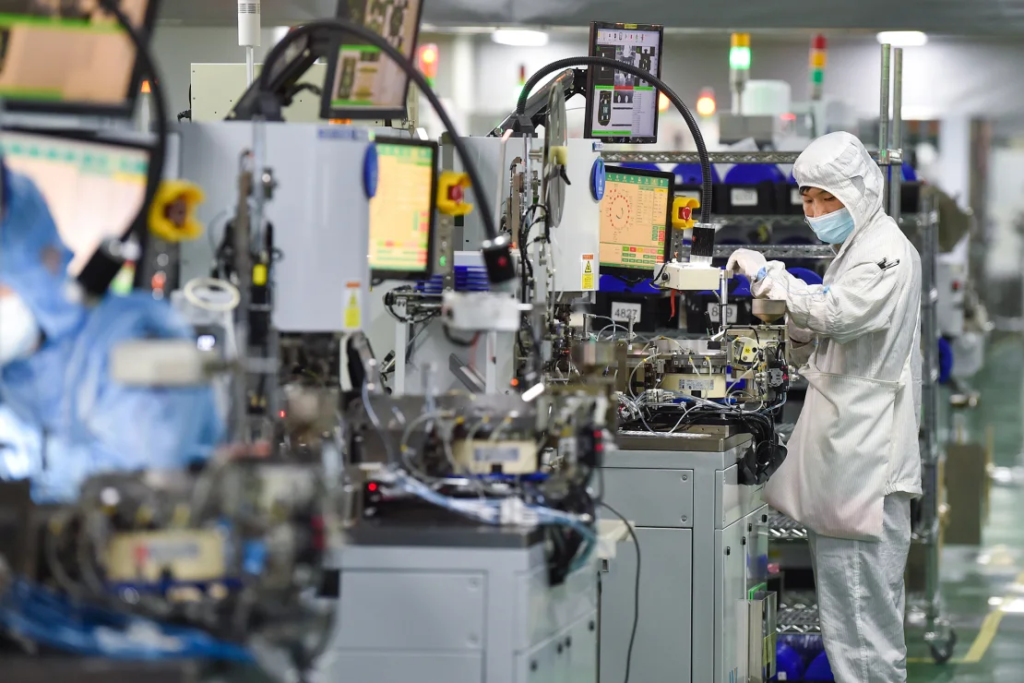

Employees work on machines at a semiconductor factory in Siyang County, Suqian City, Jiangsu, China, on March 1, 2023.

“The divergence between the Caixin and official PMIs has widened further from May, likely due to differences in the sectors covered,” said Goldman Sachs analysts on Monday.

The Caixin survey focuses on more export-oriented and consumer-related companies, while the official PMI leans towards manufacturers producing industrial materials such as steel, cement, and chemicals. These sectors are more susceptible to a slowdown in fixed-asset investments.

Analysts believe the current data reflects an economic landscape with robust exports and consumption but weaker investment.

“Demand for consumer and intermediate goods was stronger than that for investment goods,” said Wang Zhe, senior economist at Caixin Insight Group.

“Overall, the manufacturing sector kept improving in June, with supply, domestic demand, and exports continuing to grow,” he added. While June’s customs data isn’t available yet, May’s statistics showed the country’s exports increased by 7.6% from the previous year, surpassing analysts’ forecasts.

Despite this, manufacturers are less optimistic about the future, as recent tariff announcements from the US and European Union have dampened their outlook.

“The gauge for future output expectations fell by more than three points from the previous month, marking the lowest since November 2019,” Wang said.

“Concerns expressed by surveyed companies in the Caixin index focused on significant downward pressure on the economy and intense market competition,” he added.

Last month, the EU announced additional tariffs of up to 38.1% on electric vehicles imported from China, citing Beijing’s unfair support for companies that undercut European carmakers. These provisional tariffs are set to take effect by July 4, with the investigation continuing. The final duties will be established on November 2 at the end of the probe.

This decision followed the United States’ move to quadruple tariffs on EVs from China from 25% to 100%, aiming to boost American jobs and manufacturing.