Chinese President Xi Jinping convened meetings with over a dozen US CEOs and academics on Wednesday, as Beijing sought to reengage foreign investors and improve strained relations with the United States.

Foreign direct investment in China has declined recently due to factors such as slower economic growth, regulatory crackdowns, national security legislation, and concerns about the country’s long-term prospects, dampening confidence in the world’s second-largest economy.

Among the CEOs present were Cristiano Amon from Qualcomm (QCOM), Raj Subramaniam from FedEx (FDX), and Stephen Schwarzman from the Blackstone Group (BX).

Xi encouraged US businesses to maintain their investments in China and promised further reforms to open the country’s markets to foreign companies, as per a statement from the foreign ministry.

He expressed optimism about China’s growth prospects, emphasizing that the economy has not yet reached its peak. Additionally, Xi called for enhanced cooperation between China and the US across various fields, including economy, trade, agriculture, climate change, and artificial intelligence.

Xi noted an improvement in bilateral relations since his meeting with US President Joe Biden in San Francisco in November.

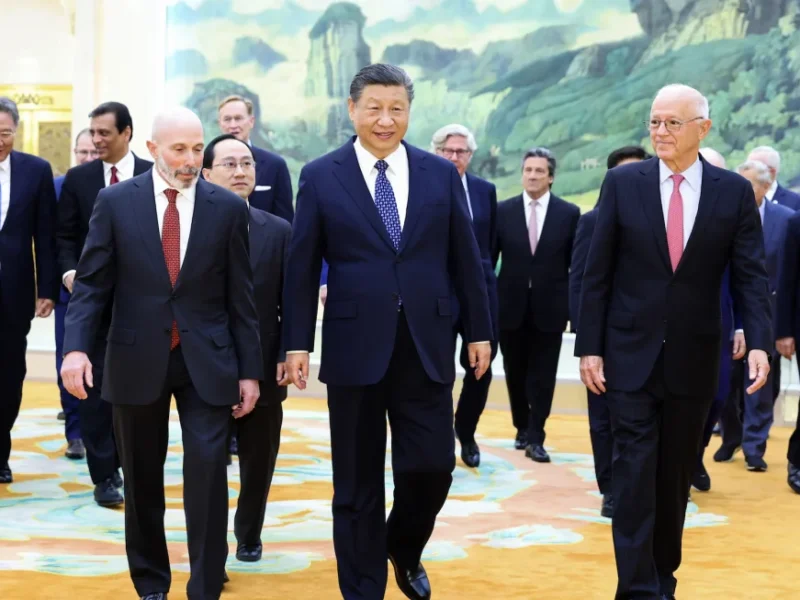

Chinese state media carefully curated the optics of Xi’s meeting with the US delegation. Footage aired by state broadcaster CCTV depicted the American guests attentively listening and nodding as Xi spoke. Photos released by state-run news agency Xinhua showed the US participants walking behind Xi in unison on a red carpet.

However, the absence of any women among the American CEOs and academics in the group photo raised concerns about inclusivity and representation.

Xi Jinping and his American guests gather for a photo opportunity prior to the meeting.

Sheena Chestnut Greitens, an associate professor of public affairs at the University of Texas-Austin, highlighted the lack of diversity among the senior visitors attending the China Development Forum, expressing concern that it does not accurately represent the breadth of expertise or policy perspectives on China in the US.

The meeting at Beijing’s Great Hall of the People followed the conclusion of a significant government forum that has historically engaged global business leaders in discussions with Chinese officials.

Approximately 100 global CEOs, along with leaders of international organizations such as the International Monetary Fund and the World Bank, convened in the Chinese capital for the annual China Development Forum this week. Chinese state media reported that more than 30 of these executives were from the US.

Amidst China’s grappling with its most significant economic challenges in decades, Beijing aims to restore confidence and stabilize foreign trade and investment. It has implemented various measures, including a 24-point action plan released by the cabinet earlier this month, to attract foreign investment and enhance market access in high-tech sectors. However, concerns persist among global investors due to China’s increased scrutiny of Western companies and a structural economic slowdown.

Foreign direct investment (FDI) into China declined by nearly 20% in the first two months of 2024 compared to the previous year, continuing a trend from 2023 when FDI decreased by 8%, according to data from the Commerce Ministry. Additionally, direct investment liabilities plummeted by 82% in 2023, marking a 30-year low, as reported by the State Administration of Foreign Exchange.

A survey by the American Chamber of Commerce in China revealed that 57% of US firms lacked confidence in China’s commitment to further opening its markets to foreign companies.

China has set a target for economic growth of around 5% for this year, similar to last year’s figure. However, market analysts view this goal as ambitious, given the absence of significant stimulus measures by the central government to address weak consumer confidence and reluctance to spend.

The Chinese economy faces numerous challenges, including a prolonged real estate downturn, deflation, mounting debt, a declining population, and a shift in economic policy towards ideological objectives, which has unsettled the private sector and deterred foreign investors.