China’s top leaders have promised to prioritize economic growth in the coming year. However, the absence of measures aimed at stimulating consumer demand could pose a challenge in fulfilling this commitment.

The annual Central Economic Work Conference (CEWC) in Beijing, known for shaping economic policies for the upcoming year, concluded with an emphasis on “focusing on economic development as the central objective and the primary pursuit of high-quality development,” as stated in the conference summary.

“For the upcoming year, our approach should remain steadfast in pursuing growth while ensuring stability, promoting stability through growth, and transitioning to the new while phasing out the old.”

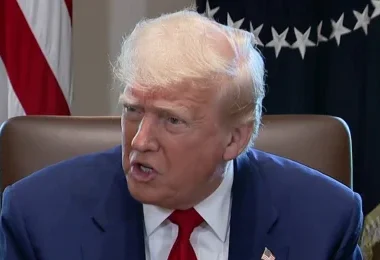

President Xi Jinping hosted the meeting, which displayed a more “pro-growth” stance compared to previous years, according to Larry Hu, the chief China economist at Macquarie Group. This proactive tone may result in setting a GDP growth target of “4.5-5%” or “around 5%” for the next year, a target similar to that of 2023.

However, some analysts are skeptical about achieving this level of growth without specific stimulus measures targeting consumers, which were notably absent from the discussions. Citi analysts noted the absence of substantial consumption support policies and detailed discussions on increasing household income.

China’s economy is currently grappling with challenges, with weak consumption being a significant obstacle. While policymakers have repeatedly pledged to boost domestic demand and stimulate consumer spending, there haven’t been large-scale stimulus measures, despite calls from economists and government advisors for more assertive actions.

UBS analysts express doubts about reaching the 5% growth target, citing ongoing growth impediments and the modest policy support stance set during the conference. They predict that growth will slow to 4.4% in the coming year.

On the morning of Monday, October 30, 2023, commuters were observed navigating a construction site in Beijing.

Fighting deflation

Apart from consumer spending, declining prices pose a significant worry, and policymakers appear to have recognized this issue for the first time in many years.

China has been grappling with declining prices throughout most of the year, primarily due to a sluggish property market and reduced spending. Deflation is concerning for the economy because both consumers and businesses may delay their purchases or investments, expecting prices to drop further. This, in turn, can further slow down economic activity, creating a damaging cycle.

The conference’s summary stated, “Total social financing and money supply should be in line with economic growth and the price target.” This implies that increasing the money supply is one of the tools that central banks can employ to combat deflation.

For the first time, the term “the price target” was added to the conference’s summary, signaling a potential shift towards more accommodative monetary policy in response to deflationary risks. This could involve interest rate cuts in the coming months, according to Hu, the chief China economist at Macquarie Group.

In the previous month, the Consumer Price Index recorded a 0.5% drop, marking the most significant decline since the depths of the pandemic three years ago. This decline represents an acceleration in the deflation rate compared to October when it fell by 0.2% year-on-year.

The top officials of the Communist Party emphasized their primary focus on constructing a modern industrial system through technological innovation.

On June 15, 2023, a woman was seen choosing clothing items at a shopping mall in Beijing.

Is there a resurgence in construction activity?

The summary of the CEWC has also excluded the statement “houses are for living in, not for speculation” for the first time since 2018. Chinese leaders introduced this phrase in 2016 when they started implementing stricter regulations for the property market. In July, the Politburo omitted this phrase from its monthly meeting statement, suggesting a potential easing of some property restrictions.

HSBC analysts noted that “property market stabilization becomes more pressing,” emphasizing that there are indications of the property market crisis affecting the broader economy, including financial markets and consumer confidence.

In its statement, the CEWC reiterated the importance of addressing risks in areas such as “real estate, local government debt, and small and medium-sized financial institutions.”

On August 22, 2023, the premises of Zhongrong International Trust, a company with partial ownership by Zhongzhi Enterprise Group, were located in Beijing.

The government plans to expedite construction efforts in three key areas: affordable housing, urban-village redevelopment, and public infrastructure facilities. This move is aimed at bolstering activity within the property sector.

The ongoing downturn in the real estate market is at the core of several economic challenges in China. The real estate industry, which has historically contributed as much as 30% of the GDP, experienced a crisis three years ago when the government took measures to curb reckless borrowing by developers.

As a result, home sales plummeted, and many developers are currently facing financial difficulties. These financial woes have spilled over into the extensive shadow banking system, including trust firms, which have provided substantial loans to developers over the years.