Bank of Japan officials see little need to alter their current approach of gradually increasing interest rates, despite uncertainties caused by US tariffs, according to sources familiar with the matter.

The officials believe that the Trump administration’s tariff policies and retaliatory measures could potentially weaken Japan’s economy and delay progress toward the BOJ’s inflation target. However, for now, their economic projections remain mostly unchanged as they await more data to assess the impact of the tariffs.

Given the wide range of possible economic outcomes, the officials feel it’s premature to factor these uncertainties into their base case and make significant changes to the bank’s policy stance.

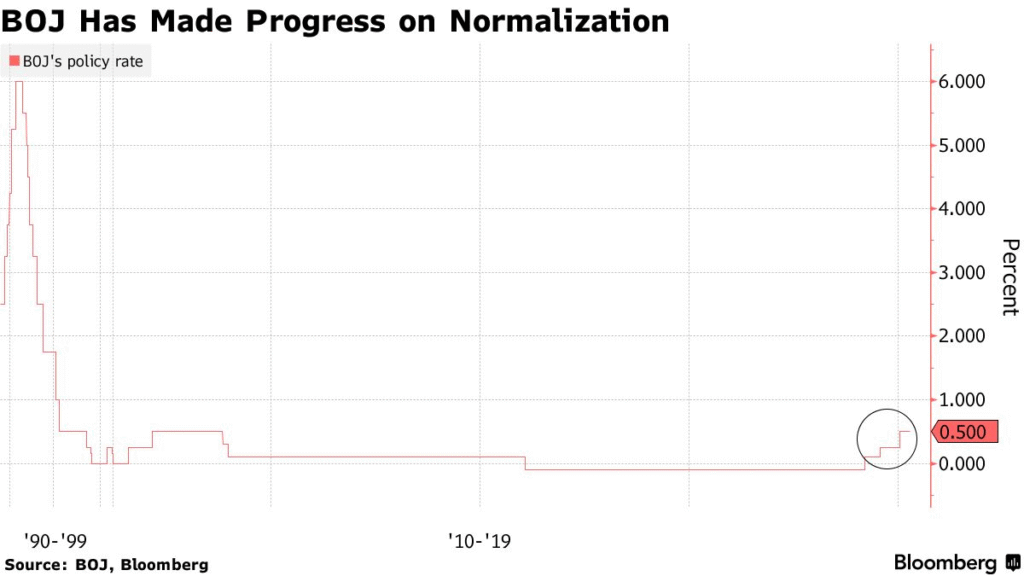

At the end of a two-day policy meeting on May 1, Bank of Japan officials will finalize decisions on the policy rate after reviewing all available data and information. While the BOJ will present its base-case view, it will likely highlight the uncertainty surrounding the economic outlook due to the impact of tariffs. The bank is widely expected to maintain its current policy settings at the meeting.

Given the range of risks to both the economy and inflation, the BOJ has been considering possible actions for a worst-case scenario.

Additionally, the central bank may revise down its price forecast in the upcoming quarterly economic report, set for release at the end of the policy meeting. This revision will likely reflect a stronger yen, falling oil prices, and potential economic weakness. The BOJ’s first core inflation projection for fiscal 2027 is expected to be around 2%.

The yen reached a seven-month high against the dollar on Monday, having appreciated about 11% against the greenback since the BOJ’s outlook report in January. Meanwhile, oil prices dropped by approximately 13% during the same period. The Japanese government also implemented a policy to make high school tuition effectively free from this fiscal year, which economists estimate will reduce the price index by about 0.2 percentage points.

The movement in the yen has had significant effects on Japan’s economy, particularly due to the country’s heavy reliance on imported energy and goods.

BOJ’s inflation forecast slightly exceeds economists’ expectations.

Regarding the timing of reaching its inflation target, the BOJ has stated that it expects inflation to align with its target in the second half of its three-year forecast period, which runs through March 2027. As is customary in April, the bank will extend the outlook period by an additional year.

Officials are also expected to discuss reducing their economic growth projection for this fiscal year, currently set at 1.1%. Barclays economists predict it will be revised down to approximately 0.5%, due to the impact of tariffs.