Apple announced it is shifting the production of most iPhones and other devices intended for the US away from China, which has been central to President Donald Trump’s tariffs.

In the coming months, most iPhones for the US market will be produced in India, while Vietnam will become a key production hub for devices like iPads and Apple Watches, according to CEO Tim Cook.

This change follows the company’s estimate that US import taxes could increase its costs by around $900 million (£677.5 million) in the current quarter, despite Trump’s decision to exempt major electronics from new tariffs.

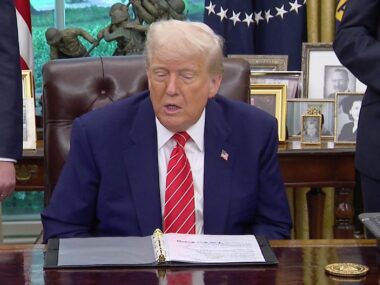

The Trump administration has consistently urged Apple to relocate production to the US. This move comes as companies globally are adapting to significant shifts in trade policies influenced by Washington’s actions.

During a call with investors to discuss financial results, Cook highlighted Apple’s ongoing investments in the US, including a plan to invest $500 billion across various states over the next four years.

Made in India

Apple confirmed it is shifting its supply chain for US-bound products away from China, with India and Vietnam positioned to benefit significantly from this move.

Tim Cook stated, “We do expect the majority of iPhones sold in the US will have India as their country of origin.”

He also mentioned that Vietnam will become the primary manufacturing hub for nearly all iPads, Macs, Apple Watches, and AirPods sold in the US.

China will continue to be the origin for most Apple products sold outside the US.

However, moving production to India will require substantial time and investment, potentially costing billions of dollars.

Shanti Kelemen, Chief Investment Officer at M&G Wealth, explained on the BBC’s Today programme that there will still be tariffs impacting Apple’s supply chains, and the costs of relocating and building new factories will be significant.

Apple has also committed to investing $500 billion over the coming years.

Apple’s stock saw a significant decline after Trump’s administration introduced “reciprocal tariffs” on imported products, aiming to incentivize US-based manufacturing. However, pressure on the administration led to exemptions for certain electronics, including phones and computers, soon after the tariffs were enacted.

Uncertainty Prevails.

For now, trade disruptions have not affected Apple’s sales.

The company reported a 5% increase in revenue for the first three months of the year, reaching $95.4 billion, compared to the same period last year. Amazon, another tech giant closely monitored for signs of tariff impacts, also reported solid sales, with its North American e-commerce business growing 8% year-on-year in the most recent quarter.

Amazon anticipates similar growth in the coming months.

Amazon CEO Andy Jassy acknowledged the uncertainty surrounding tariffs, stating, “Obviously no one of us knows exactly where tariffs will settle or when.” However, he pointed out that the company has emerged stronger from past disruptions, like the pandemic, and remains optimistic about handling future challenges. “We’re often able to weather challenging conditions better than others,” he said. “I’m optimistic this could happen again.”

New Strategic Positioning.

The move to shift iPhone production to India has been described as “impressive” by Patrick Moorhead, CEO of Moor Insights & Strategy. He noted that it marks a significant departure from Tim Cook’s previous stance, when he stated that only China could manufacture iPhones. Moorhead acknowledged that while there is still considerable progress to be made, this represents a strong start.

Amazon, too, is repositioning to bolster its resilience against tariffs. The company emphasized its efforts to diversify its seller base, with CEO Andy Jassy expressing confidence in Amazon’s preparedness for the future. He highlighted the company’s scale and its role in supplying everyday essentials as key factors in its ability to weather challenges.

Despite tariff-related disruptions, Amazon reported that its sales have not been negatively impacted. In fact, executives suggested the company may have even benefitted as some customers began stockpiling. Overall, Amazon’s sales increased by 9%, reaching $155.7 billion in the first three months of 2025, compared to the same period last year, while profits surged over 60%, reaching approximately $17 billion.