The UK economy’s resurgence in August has heightened the anticipation that interest rates will once more remain stable in the upcoming month.

In August, the economy experienced a marginal growth of 0.2% following a significant decline in July. Analysts characterized these numbers as lackluster, attributing the subdued economic performance to increased borrowing costs and the rising cost of living, which is placing a burden on both consumers and businesses.

Interest rates remained unchanged at 5.25% in September, marking the end of a series of 14 consecutive rate hikes triggered by a slowdown in inflation.

Economists noted that these statistics depict an economy that is only making slow progress. They expressed concerns that the full impact of previous rate hikes has yet to be felt, and as a result, the threat of a recession still looms on the horizon, offering little relief to strained budgets. Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown, added that the Bank of England appears poised to maintain its pause on interest rate hikes.

The United Kingdom is not presently experiencing a recession, but concerns persist about its sluggish growth. The economy is expected to be a pivotal issue in the upcoming election, anticipated to take place next year.

In September, Bank of England Governor Andrew Bailey mentioned that there were “increasing signs” that the higher interest rates were starting to have a negative impact on the economy.

Dr. Swati Dhingra, a member of the Bank of England’s nine-strong rate-setting committee, shared her perspective with the BBC, stating that “it is not going to be great times ahead” given the slow growth. She added, “When you’re growing as slowly as we’re growing now, the chances of recession or not having a recession are pretty evenly balanced.”

The slight economic growth observed in August was primarily driven by the education sector recovering from strike action, along with contributions from computer programmers and engineers. However, some sectors performed poorly, such as arts, entertainment, and recreation, where sports and amusement activities saw a decline of over 10% in August.

Darren Morgan, the director of economic statistics at the ONS, noted that August was relatively quiet in terms of significant factors affecting the economy compared to previous months, where various events influenced both growth and decline.

There’s a growing concern that the UK might be in a period of stagflation, characterized by economic stagnation coupled with elevated inflation. With economic growth so minimal, some experts are beginning to see a recession as almost inevitable, particularly given that the full impact of higher borrowing costs on consumers has yet to be realized, eroding economic resilience.

Yael Selfin, Chief Economist at KPMG UK, expressed that the UK’s outlook remains lackluster due to the continued impact of high interest rates. Thomas Pugh, an economist at consultancy firm RSM UK, suggested that flatlining growth points to interest rates remaining unchanged in November.

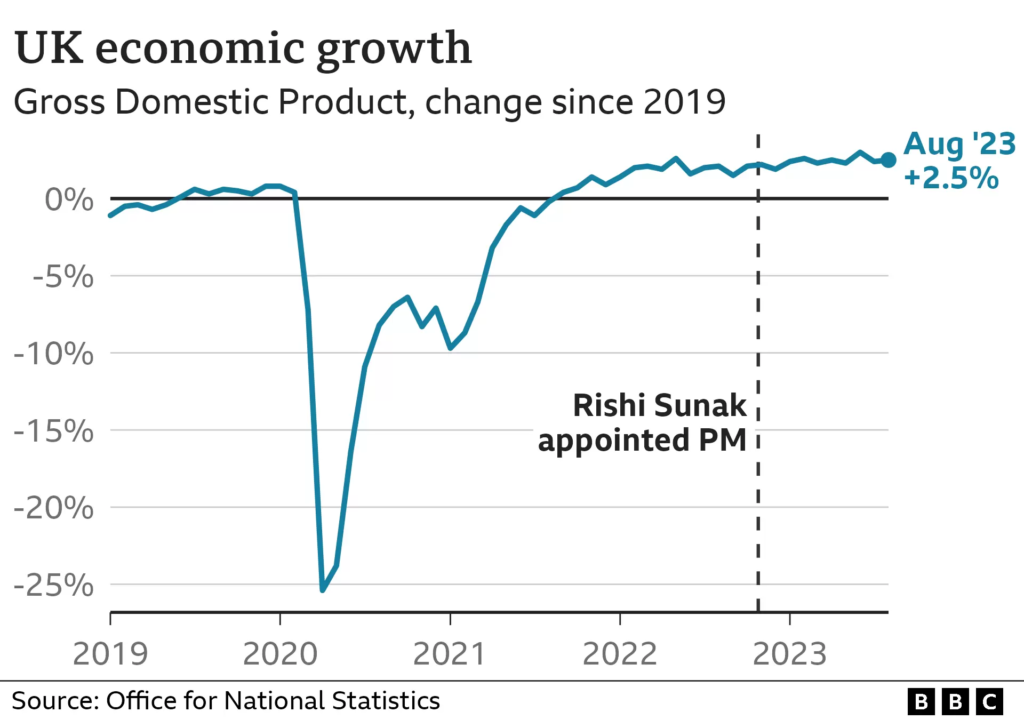

Gross Domestic Product (GDP) figures serve as an indicator of the health of the UK economy. They aim to measure all economic activities conducted by companies, governments, and individuals in a country. An increasing GDP reflects economic growth and an improvement in people’s financial well-being on average. Conversely, a declining GDP indicates economic contraction, which can be problematic for businesses. If GDP contracts for two consecutive quarters, it is generally classified as an economic recession.

The upcoming figure, which will reveal the economy’s performance over the past three months, will be closely monitored, carrying more significance than the single monthly figure for August.

According to the Office for National Statistics (ONS), the economy has exhibited “modest” growth over the previous three months, benefiting from the upswing in car manufacturing and sales, as well as the construction sector.

Chancellor Jeremy Hunt asserted that the latest data demonstrates the economy’s greater resilience than initially anticipated. However, shadow chancellor Rachel Reeves argued that, under the Conservatives, the UK’s economy remains ensnared in a low-growth, high-tax cycle, adversely affecting the well-being of working people.

In a recent development, the International Monetary Fund (IMF) clashed with the UK government after the Treasury challenged the IMF’s assessment of the UK economy as overly pessimistic. The IMF predicts that the UK will experience the highest inflation and slowest growth among the G7 economies next year, but the Treasury contended that the IMF’s report had not taken into account recent revisions to UK growth.

It’s worth noting that the economy has now grown by 2.1% compared to its pre-pandemic size in February 2020.