Within the technology sphere, 2023 could be notable as the year when generative AI became widely embraced by the public.

Generative AI systems have gained prominence across various domains, including coding, artistic creations, and essay writing. While not flawless, they have become indispensable tools in several industries and professions.

Microsoft-backed ChatGPT led the way with its launch in late 2022, and competitors have been entering the scene since then.

A significant development this month came from Alphabet, the parent company of Google, as they unveiled Gemini—an AI to be integrated into Google’s products, including its chatbot and search engine. Alphabet claims that Gemini surpasses the current version of ChatGPT.

However, OpenAI, the creator of ChatGPT, is not resting on its laurels. They have promised a more potent iteration of their software for the upcoming year.

During a software developer conference in November, OpenAI’s CEO, Sam Altman, stated, “What we launched today will seem quite outdated compared to what we are currently developing for you.”

Sam Altman predicts that the existing AI will appear “quaint” in comparison to what is on the horizon.

In the meantime, investors are eagerly funneling funds into the industry, hoping to support the next major player.

According to PitchBook, venture capital firms around the world have injected $21.4 billion (£17.5 billion) into generative AI startups, just up to the end of September. To put this in perspective, in the entire year of 2022, only $5.1 billion was invested.

However, some caution against getting overly carried away. Ben Wood, the chief analyst at CCS Insight, suggests that generative AI may face a reality check in 2024.

He notes that the hype has overlooked a few challenges that could temporarily hinder its progress. For instance, developing and operating a generative AI system is highly expensive, requiring significant computing power and costly computer chips, which are currently in short supply. To address these costs, he anticipates that some AI systems may transition to hybrid models, where some processing takes place locally on users’ laptops or phones.

Mr. Wood also highlights the potential impact of regulation and legal battles, which could dampen the current enthusiasm for generative AI. He suggests that companies might invest heavily in AI-powered services only to later roll back some of their operations to comply with regulations.

Electrical jolt

Ford is one of the companies that has temporarily halted its intentions to increase electric vehicle (EV) manufacturing.

In the first quarter of the upcoming year, the United Kingdom is set to welcome its one millionth all-electric car onto its roads, as reported by Schmidt Automotive Research. This achievement will position the UK as the second market, following Germany, to reach this significant milestone.

However, despite this progress, 2024 is anticipated to be another challenging year for electric vehicle (EV) manufacturers. Towards the end of 2023, companies like Ford, GM, and Tesla decided to temporarily suspend their plans for expanding EV production. In October, Mercedes-Benz characterized the electric vehicle market as “harsh,” attributing this assessment to a price competition and difficulties within the supply chain.

Analysts don’t foresee the situation getting notably easier. Auto market analyst Matthias Schmidt predicts a stagnant year for EV sales across Europe in 2024. In traditionally robust markets like Germany and Norway, he anticipates minimal to no growth at all.

Nevertheless, the UK might shine as a bright spot due to the introduction of the zero-emission vehicle (ZEV) mandate. Starting in January, over one-fifth of vehicles sold are required to be electric, with the target expected to reach 80% by 2030.

This development could be positive news for potential EV buyers. Schmidt explains, “It will be a favorable market for buyers, particularly concerning electric cars, as manufacturers rush to meet ZEV mandate targets.” He adds that these reductions in prices may not be explicitly apparent, as they could be concealed through financing offers and enhanced trim levels without additional costs, as manufacturers might be cautious about openly reducing prices.

Robots designed in the likeness of humans

Humanoid robots may become more practical in the coming year. At Tesla, engineers are actively developing Optimus, a humanoid robot aimed at performing basic factory tasks.

A recent video release showcased the latest iteration of Optimus, which is lighter than its predecessor, features new hands, and is powered by improved motors.

Elon Musk mentioned in July that they anticipate Optimus will be capable of working in a Tesla factory by 2024. He stated, “In terms of when it will be able to do some useful things, we’ll first be trying this out in our own factories – proving out its utility. But I think we’ll be able to have it do something useful in our factories sometime next year. I’m pretty confident of that.”

Tesla faces competition in the humanoid robot arena, with other companies already training robots to perform tasks in workplace settings. Amazon, for instance, is testing a humanoid robot named Digit in its warehouses. Digit can move, grip, and handle items similarly to a human and has been developed by Agility Robotics, which intends to supply Digit robots to other customers in the upcoming year.

Meanwhile, in Canada, Sanctuary AI is training its robot, known as Phoenix, to carry out specific tasks such as packing bags. The plan for 2024 is to expand the range of tasks that Phoenix can accomplish.

Competition to lose weight.

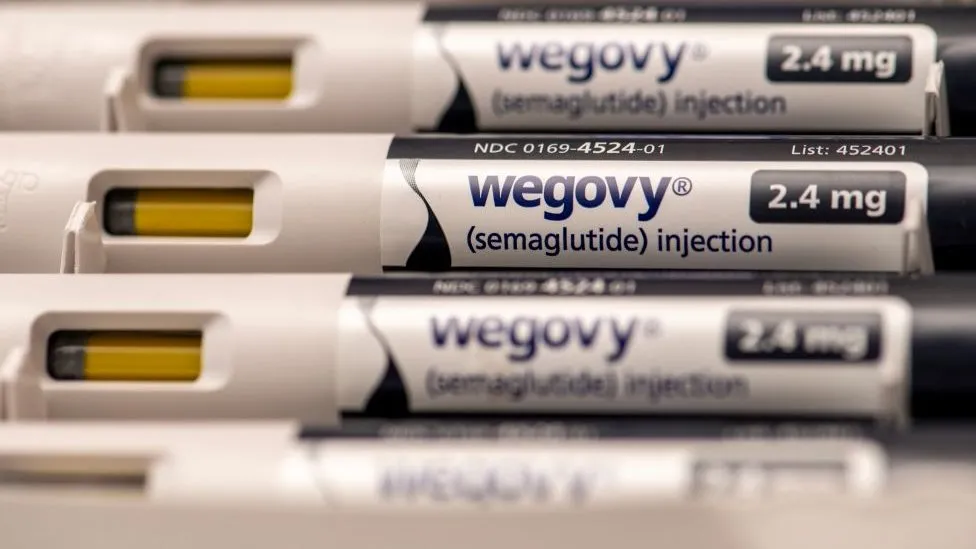

In the pharmaceutical industry, one treatment has been selling so rapidly that its manufacturer is struggling to keep up with the demand.

The weight-loss medication known as semaglutide, sold under the brand name Wegovy, has achieved immense success, briefly elevating its owner, Novo Nordisk, to the position of Europe’s most valuable company.

To address the high demand, the Danish company is investing billions of euros in expanding its production facilities.

Currently, Wegovy is administered as a weekly injection, but a tablet version is in the final stages of development. Novo Nordisk has not disclosed when it expects to release this tablet to the market.

However, Novo Nordisk can anticipate increased competition in the coming year. Eli Lilly’s weight-loss drug, Mounjaro, has recently gained approval as a treatment for weight loss in the United States and the United Kingdom, with European Union approval appearing likely soon.

Additionally, Pfizer is in the process of seeking approval for its own weight-loss pill.