The increase in oil prices is driven by apprehensions that the Israel-Gaza situation might disrupt oil production in the Middle East.

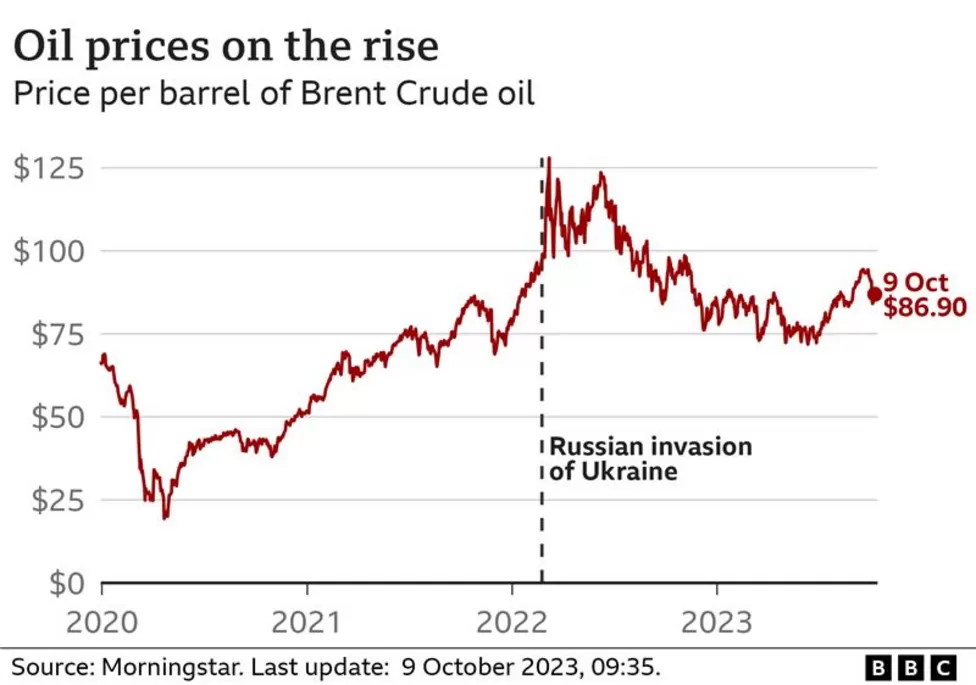

The international benchmark for oil, Brent crude, increased by $2.25 per barrel to $86.83, and U.S. oil prices also saw an uptick.

Although Israel and the Palestinian territories don’t produce oil themselves, the Middle East region accounts for nearly a third of the world’s oil supply.

The Hamas attack on Israel marks a significant escalation in the conflict, the largest in decades. Western nations strongly condemned these attacks. A Hamas spokesperson revealed that the group had received direct support from Iran, which is one of the world’s major oil-producing nations.

However, Iran denied any involvement in the assault during a UN Security Council meeting in New York, as reported by Reuters. Nevertheless, Iranian President Ebrahim Raisi expressed support for the attack.

In response, Israel instructed the U.S. oil company Chevron to temporarily halt production at the Tamar natural gas field located off the northern coast of the country, which is within rocket range from the Gaza Strip. Israel’s energy ministry, which has previously closed the field during times of unrest, stated that there is sufficient fuel from other sources to meet the country’s energy requirements.

Israel’s largest offshore gas field, Leviathan, remains operational as usual, as confirmed by Chevron. According to energy analyst Saul Kavonic, the surge in global oil prices is primarily due to concerns about a broader conflict that could potentially impact major oil-producing nations nearby, such as Iran and Saudi Arabia.

On Monday morning, the price of West Texas Intermediate crude, the U.S. benchmark, rose by $2.50 per barrel to reach $85.30.

Saul Kavonic pointed out that if the conflict extends to Iran, which has been accused of supporting Hamas attacks, up to 3% of the world’s oil supply could be in jeopardy.

Caroline Bain, the chief commodities economist at Capital Economics, mentioned on the BBC’s Today program that Iran has been increasing its oil production throughout the year despite U.S. sanctions. She also noted that the U.S. has seemingly overlooked this rising production, and it may become more challenging to ignore in the future.

In summary, Capital Economics anticipates that oil demand will surpass supply in the final quarter of the year, supporting the expectation of higher oil prices.

Kavonic added that approximately a fifth of global oil supply would be at risk if the passage through the Strait of Hormuz, a critical oil trade route, were disrupted. The Strait of Hormuz is vital for major oil-exporting nations in the Gulf region, whose economies rely heavily on oil and gas production.

The unfolding events and uncertainty in the coming days may prompt investors to seek refuge in U.S. Treasury bonds and the dollar, both of which are traditionally favored during times of crisis, as noted by James Cheo from HSBC bank.

Israel’s central bank announced its intention to sell up to $30 billion of foreign currency to stabilize the markets and support the shekel, which has experienced a significant decline.

“At this stage, there is a bit of nervousness. [Investors] want to see a little more clarity, particularly regarding economic data and the developments associated with geopolitical uncertainty,” Mr. Cheo added.

In the aftermath of Russia’s invasion of Ukraine in February 2022, oil prices surged, reaching over $120 per barrel in June of that year. Although they dropped to just above $70 per barrel in May this year, they have been steadily increasing as producers have attempted to limit output to bolster the market.

Major oil producer Saudi Arabia, for instance, committed to reducing its production by a million barrels per day in July. Other members of OPEC+, a coalition of oil-producing nations, also agreed to ongoing production cuts in an effort to stabilize falling prices. OPEC+ collectively accounts for approximately 40% of the world’s crude oil, underscoring the significant impact its decisions can have on oil prices.