The International Monetary Fund has dismissed government claims that its recent evaluation of the UK economy is excessively pessimistic.

The influential global organization predicts that the UK will experience the highest inflation and the slowest economic growth among G7 nations in the coming year, trailing behind the US, France, Germany, Canada, Italy, and Japan.

The Treasury has contested the IMF’s assessment, noting that recent revisions to UK growth have not been factored into the IMF’s report. However, the IMF has defended its outlook, rejecting claims of pessimism.

Pierre Olivier Gourinchas, the IMF’s chief economist, told the BBC, “We’re projecting a growth rate that surpasses the Bank of England’s estimate for next year, so I don’t believe our outlook is particularly pessimistic. We aim to provide an honest interpretation of the available data.”

Forecasts are inherently imperfect due to the multitude of factors influencing economic growth, including geopolitics and even weather. Nevertheless, such reports can offer valuable insights, particularly when they align with other predictions.

The IMF, an international organization comprising 190 member countries, has stated that its growth forecasts for the following year in most advanced economies have typically been accurate within a margin of about 1.5 percentage points of the actual outcomes.

- What is the International Monetary Fund (IMF), and what significance does it hold?

In July of the previous year, the IMF predicted a 3.2% growth rate for the UK’s economy in 2022. However, at the beginning of this year, they raised that estimate to 4.1%. Interestingly, official figures from the UK, released last month, indicated that the country’s economy actually expanded by 4.3% in 2022, surpassing the IMF’s initial projection.

The IMF, in its most recent biannual forecast, anticipates that the UK will experience faster growth than Germany in 2023, which would keep the UK from having the lowest growth rate among the G7 nations. Nevertheless, the IMF has downgraded its outlook for the UK in the following year, estimating a mere 0.6% growth in 2024. This would position the UK as the slowest-growing developed country, a prediction particularly significant as it’s expected to be a year of general elections.

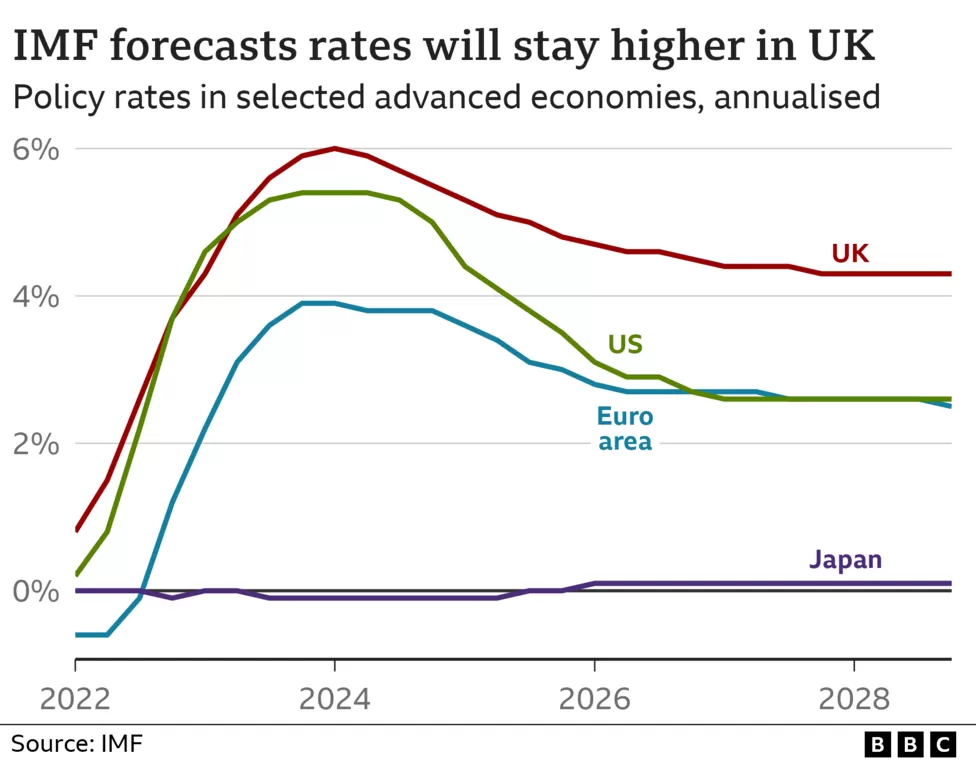

One of the key factors affecting the UK’s short-term economic prospects, as per the IMF, is the need to maintain high interest rates to control inflation, which, while decreasing, remains persistently above the target level. The IMF warned that the Bank of England’s interest rates would peak at 6% and remain at around 5% until 2028, whereas they currently stand at 5.25%.

This projection from the IMF has surfaced at an inopportune moment for the UK government, which is actively promoting the idea that the economy is at a turning point, with inflation on a decisive decline and interest rates likely having reached their peak. Government sources have suggested that the IMF may not have accounted for the recent decrease in market interest rate expectations and the Office for National Statistics’ upgraded assessment of the UK’s post-pandemic recovery. However, the IMF’s chief economist, Mr. Gourinchas, has refuted this, stating that the IMF did indeed factor in the recent peak in interest rates and that there is no discrepancy. He also noted that while revised data from the ONS altered the 2021 picture somewhat, it is unlikely to significantly impact the current growth forecasts. In fact, past upgrades for 2021 may mean there is less room for growth and catch-up, potentially limiting a substantial upward change in growth performance.

In response to the recent IMF report, Chancellor Jeremy Hunt stated, “The IMF has revised growth projections for this year, with a downgrade for the following year. However, they anticipate that our long-term growth will surpass that of France, Germany, or Italy. To achieve this, we must address inflation and take further measures to stimulate economic growth.”

On Tuesday, the Bank of England’s Financial Policy Committee (FPC), responsible for monitoring the stability of the UK financial system, also expressed concerns about the persistently high interest rates in the UK. The FPC pointed out that financial markets expect interest rates to remain elevated for an extended period, which could place pressure on households’ finances. It emphasized that the full impact of these higher interest rates has yet to affect all borrowers.

The IMF is already cautioning about signs of a slowdown in the global economy, despite what initially appeared to be a robust start to the year. While the tourism sector had rebounded after the pandemic, benefiting economies heavily reliant on travel and tourism, such as Italy, Mexico, and Spain, a slowdown in interest-rate-sensitive manufacturing industries was hindering overall growth. Additionally, there were indications that China’s momentum had waned following its strong initial recovery at the beginning of 2023.

The IMF’s projection is that global economic growth will decrease from 3.5% in 2022 to 3% in 2023 and 2.9% in 2024. IMF’s Mr. Gourinchas remarked, “The global economy is still rebounding from the pandemic and the Russia-Ukraine conflict, displaying impressive resilience. However, growth remains sluggish and uneven. The global economy is progressing, but not at a rapid pace.”