A few days after Donald Trump won the U.S. presidential election, Amber Walliser spent $2,000 (£1,538) on appliances, anticipating price increases due to new import taxes imposed by the White House.

However, that spending spree was short-lived. Now, her family is cutting back, concerned about job stability and a potential economic downturn—an outcome experts say could be exacerbated by Trump’s tariffs.

As a result, major expenses like a new car or a vacation are off the table this year. They have even postponed plans to try for a second child.

“We’re saving as much as possible, stockpiling cash, and building up our emergency fund,” said the 32-year-old accountant from Ohio.

Amber’s concerns are shared by many across the U.S., as tariffs and other White House policies disrupt financial markets, create uncertainty for businesses, and fuel inflation worries.

This presents a challenge for U.S. central bank officials, who will address interest rates at their meeting on Wednesday.

The Federal Reserve, responsible for maintaining price stability and employment, typically lowers rates to boost the economy or raises them to curb inflation, as it did in 2022 when prices surged.

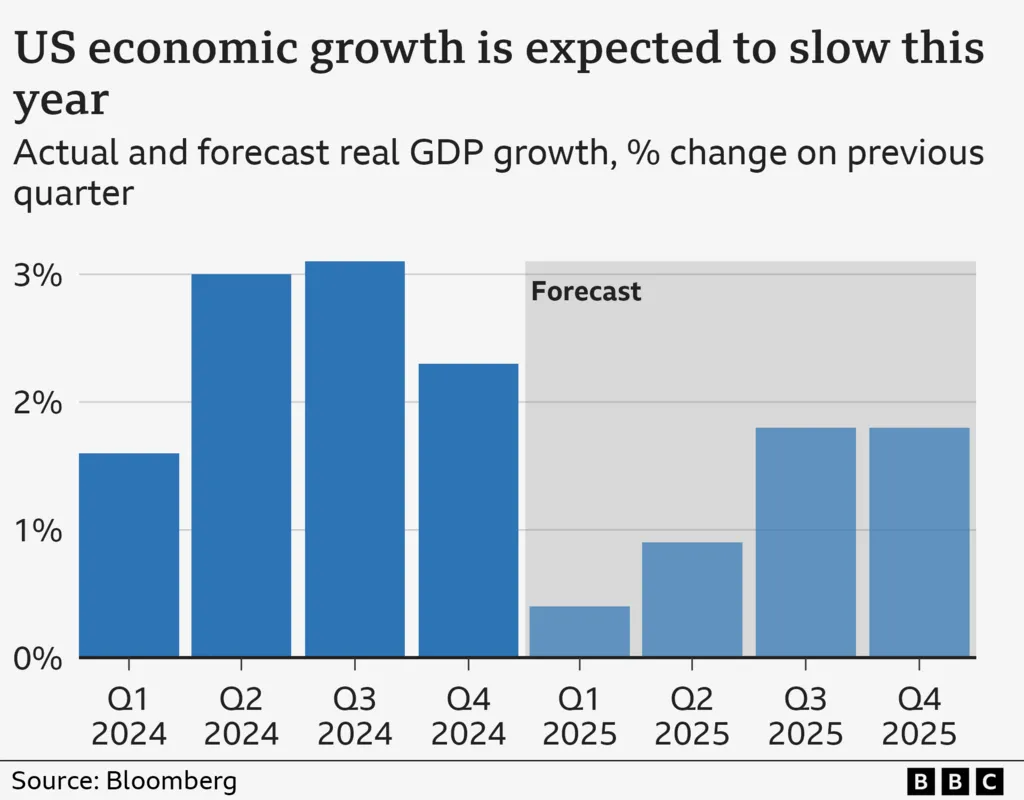

While analysts expect the Fed to keep rates unchanged this time, opinions vary on future decisions, as tariffs could both drive up prices and slow economic growth.

“Their job just got a lot tougher,” said Jay Bryson, chief economist at Wells Fargo.

Earlier this month, Federal Reserve Chair Jerome Powell pointed out that sentiment surveys have not been reliable indicators of spending behavior in recent years. Despite negative perceptions, the economy has performed well across key metrics.

He noted that policymakers could take a wait-and-see approach before reacting to the effects of White House policy changes.

Households are already adjusting to economic uncertainty.

After recent stock market losses affected his investments, Dave Gold created a budget and significantly reduced his expenses.

He canceled Netflix, avoided Amazon purchases for a month, and cut back on travel—slashing his spending by half.

“It’s really difficult to plan ahead with confidence,” said the 37-year-old finance professional from Wyoming.

“I felt it was time to scale back and protect myself in case things take a turn,” he added.

Dave is not alone in tightening his budget. Retail sales declined last month, and major companies like Walmart and Delta Air Lines have reported weakening demand.

At the same time, job growth has slowed, and the stock market has dropped to its lowest level since September.

This month’s University of Michigan consumer sentiment survey revealed a sharp rise in job market concerns—the highest since the Great Recession—while long-term inflation expectations saw their biggest one-month increase since 1993.

These are warning signs for the U.S. economy, where consumer spending drives nearly two-thirds of activity.

“The consumer isn’t collapsing, but there are signs of strain,” said Jay Bryson, who now estimates the chance of a recession at one in three, up from one in five earlier this year.

“If consumers cut back, the entire economy will follow,” he warned.

Egg prices have surged significantly in recent months.

White House officials have admitted the possibility of some disruption but maintain that short-term challenges will lead to long-term benefits.

However, polls indicate growing public concern over Trump’s economic policies—not only among Democrats and independents but also increasingly among Republicans.

Software engineer Jim Frazer, who did not support Trump, remains uneasy despite the administration’s reassurances. He sees frequent policy shifts, market declines, and rising prices for essentials like eggs as troubling signs.

Late last year, the 49-year-old Nebraska resident bought a new phone and television, anticipating price hikes from Trump’s planned tariffs on Chinese imports.

Recently, however, he has started cutting back, both to offset rising costs and due to uncertainty over the administration’s broader policies—including discussions about annexing Canada as a 51st state.

He and his wife have postponed replacing an old loveseat and scaled down their bathroom renovation plans.

“Right now, we need to keep our savings in a safe place,” he said.

“It feels like something is coming, and we need to be ready.”