WH Smith led midcaps lower on Wednesday as the retailer missed a recently increased profit prediction, which contributed to a slight decline in the FTSE 100 of Great Britain. Recent economic data from the U.S. and Europe have continued to weaken global mood.

The heavily weighted FTSE 100 index (.FTSE) fell 0.2%, but it still experienced less of a drop than the larger STOXX 600 (.STOXX) as the pound fell to a low close to three months versus a strengthening dollar.

A four-day losing trend was broken by the midcap FTSE 250 index’s (.FTMC) 0.2% decline.

Stronger-than-expected U.S. services sector statistics signaled that inflation pressures are still present while global markets continued to decline.

Data revealed that orders for British construction companies fell precipitously in August, adding to worries about a sluggish economy in the face of rising interest rates.

Materials and construction index (.FTNMX501010) decreased 1.1%.

Even though yearly revenue increased by 28%, WH Smith (SMWH.L) slumped 6.3% after the store missed a previously boosted profit target.

The worst day in more than seven weeks was experienced by the personal goods index, which was down 4.0% and led sectoral falls.

Shares of cyber-security firm Darktrace (DARK.L) fell 2.5% after it said that adjustments to its sales commission would reduce its earnings margin in the current year.

Darktrace needs consistent delivery in order to gain the market’s trust, according to Russ Mould, director of investments at AJ Bell.

After the alternative asset fund manager announced it will purchase Energy Capital Partners for an initial 835 million pounds ($1.05 billion), including debt, Bridgepoint (BPTB.L) shares increased by 8.2%.

As investors watch for anticipated monetary policy announcements from the Bank of England (BoE) and U.S. Federal Reserve later this month, markets remain cautious.

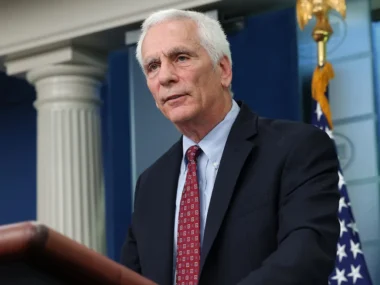

Andrew Bailey, the governor of the Bank of England, said that although the central bank is “much nearer” to stopping its cycle of interest rate hikes, borrowing costs may yet need to climb further due to persistent inflation pressures.

Later this month, the BoE is predicted to increase borrowing costs once again, to 5.5%.