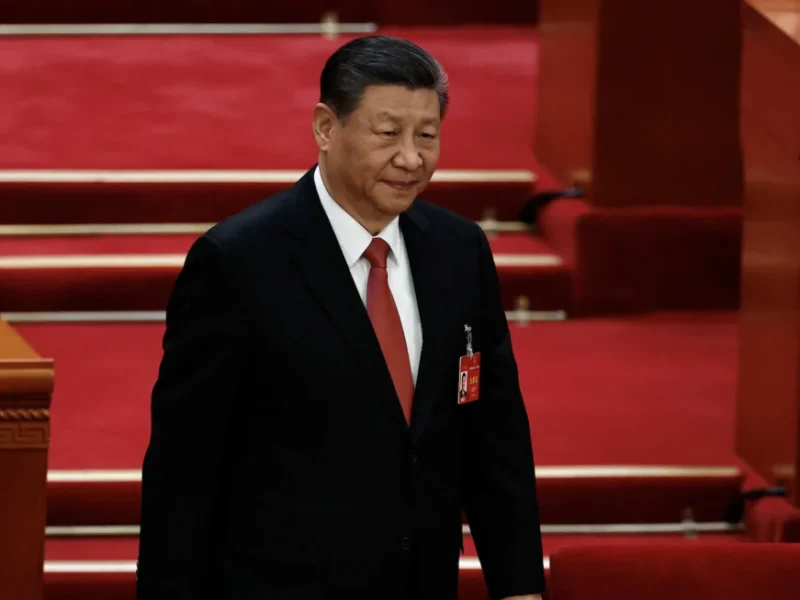

Chinese leader Xi Jinping convened with over a dozen US CEOs and academics on Wednesday as part of Beijing’s efforts to reengage foreign investors and mend strained relations with the United States.

Foreign direct investment in China has declined recently due to slower growth, regulatory crackdowns, stringent national security legislation, and uncertainties regarding the country’s long-term prospects, which have shaken confidence in the world’s second-largest economy.

The group of CEOs included Cristiano Amon of Qualcomm, Raj Subramaniam of FedEx, and Stephen Schwarzman of the Blackstone Group. Xi extended an invitation to US businesses to “continue to invest in China” and promised further reforms to open the country’s markets to foreign firms. He expressed confidence in China’s growth prospects, stating that the economy has not yet reached its peak.

Xi also called for enhanced cooperation between China and the US across various domains, including traditional areas like economy and trade, as well as emerging fields such as climate change and artificial intelligence. He noted that bilateral relations have improved since his meeting with US President Joe Biden in November.

The meeting, held at Beijing’s Great Hall of the People, followed the conclusion of a major government forum that aimed to engage global business leaders with Chinese officials. Around 100 global CEOs and heads of international organizations attended the annual China Development Forum, with over 30 of them being US executives.

China is striving to restore confidence and stabilize foreign trade and investment amid significant economic challenges. Measures introduced since last year, including a 24-point action plan to attract foreign investment and expand market access in high-tech sectors, aim to address these challenges. However, global investors remain cautious due to China’s increased scrutiny of Western companies and a structural economic slowdown.

Foreign direct investment into China declined by nearly 20% in the first two months of 2024 compared to the previous year, following an 8% decrease in 2023. Another measure of FDI, direct investment liabilities, experienced an 82% decline in 2023, the lowest in 30 years.

A survey by the American Chamber of Commerce in China revealed that 57% of US firms lacked confidence in China’s commitment to further opening its markets to foreign companies.

Despite setting this year’s economic growth target at around 5%, the same as last year’s, China faces numerous challenges, including a downturn in real estate, deflation, debt issues, a declining population, and a shift in economic policy towards ideological objectives, which has unsettled the private sector and deterred foreign investors.