US markets experienced a decline last Friday, breaking a five-week winning streak, following disappointing inflation data that reignited concerns about the economy and interest rates on Wall Street.

Recent months had seen a decrease in worries about high prices and elevated interest rates due to positive economic reports and Federal Reserve forecasts, which suggested the possibility of a smooth economic transition. However, last week’s inflation indicators, including the Consumer Price Index and Producer Price Index, exceeded expectations, causing market anxiety.

Comments from Federal Reserve officials, such as Richmond Fed President Thomas Barkin and Fed’s Raphael Bostic, further fueled concerns. Barkin indicated that the Fed requires more confidence before considering rate cuts, while Bostic expressed uncertainty about inflation trends.

Despite positive economic indicators, Wall Street’s concerns have resurfaced.

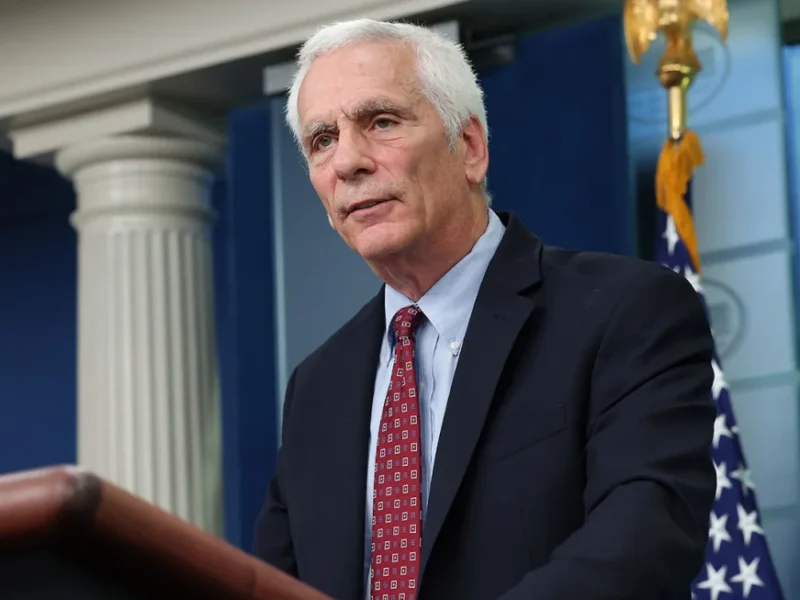

Jared Bernstein, chair of the White House Council of Economic Advisers, remains unworried about the recent inflation reports. He emphasizes the importance of focusing on long-term economic trends and the underlying dynamics supporting price stability.

Bernstein highlights the mixed nature of recent economic data, with some indicators surpassing expectations while others fall short. He underscores the importance of considering broader economic trends rather than fixating on short-term fluctuations.

Regarding the stock market’s reaction, Bernstein suggests that it may not necessarily reflect economic fundamentals but rather market sentiment and speculation. He cautions against drawing strong economic conclusions from market movements.

Bernstein also addresses concerns about the disconnect between Wall Street and main street economics, noting that while more households are investing in the stock market, not everyone is deeply involved. He attributes the market rally to various economic factors, including the administration’s policies and the strength of the US economy compared to other advanced economies.

In response to questions about the rapid growth of large tech companies, Bernstein acknowledges the importance of monitoring their size and influence. However, he suggests that broader market indices provide a more balanced perspective on market performance.

Finally, Bernstein discusses household debt levels, noting that while they have increased from pandemic lows, they are not yet alarming. He emphasizes the importance of monitoring debt service as a share of income, highlighting the growth of inflation-adjusted disposable income as a positive factor in managing debt burdens.

Capital One is acquiring Discover in a significant deal valued at $35.3 billion.

Capital One has revealed its plans to acquire Discover Financial Services for $35.3 billion in an all-stock transaction, aiming to strengthen its position in the competitive credit card market. As reported by Elisabeth Buchwald, my colleague, under the terms of the agreement announced on Monday evening, Discover (DFS) shareholders will receive slightly more than one share of Capital One (COF) for each Discover share they hold. This represents an approximate 27% premium over Discover’s closing share price of $110.49 on Friday. Should the deal proceed as planned, current Capital One shareholders will possess a 60% stake in the merged entity, with Discover shareholders holding the remaining 40%. Capital One anticipates the transaction’s completion in late 2024 or early 2025.

Israel’s economy experienced a significant downturn of 19.4% in the fourth quarter, attributed to the toll taken by ongoing conflict.

Israel experienced a significant decline in economic output during the last quarter of 2023, marking the first contraction in nearly two years due to the ongoing conflict with Hamas, as reported by my colleague Hanna Ziady.

According to Israel’s Central Bureau of Statistics, the gross domestic product (GDP) fell by 19.4% on an annualized basis compared to the previous quarter, which had seen a growth of 1.8% (revised figure) from July to September.

The unexpected downturn was primarily fueled by a sharp 26.9% decrease in private consumption, driven by a loss of confidence following the attacks on October 7, leading households to reduce their spending. Business fixed investment plummeted by 67.8%, mainly due to a significant slowdown in residential construction resulting from military call-ups and a decrease in Palestinian labor.

Exports also saw a decline of 18.3%. Liam Peach, senior emerging markets economist at Capital Economics, stated that although a recovery seems probable in the first quarter, the overall GDP growth for 2024 is likely to be one of the weakest on record.

In 2023, Israel’s economy grew by 2%, according to the statistics office.