According to the government’s forecasting agency, the UK economy is projected to expand at a slower pace than previously anticipated over the next two years, due to prolonged high inflation.

The Office for Budget Responsibility (OBR) predicts that living standards in the UK won’t return to their pre-pandemic levels until 2027-28.

This announcement follows the chancellor’s Autumn Statement, which included tax cuts and an increase in benefits. Labour criticized these measures as a response to the economic mismanagement by the Conservatives.

The OBR, an independent body, issues two economic forecasts annually to help predict government finances. These forecasts are based on current projections and are subject to change.

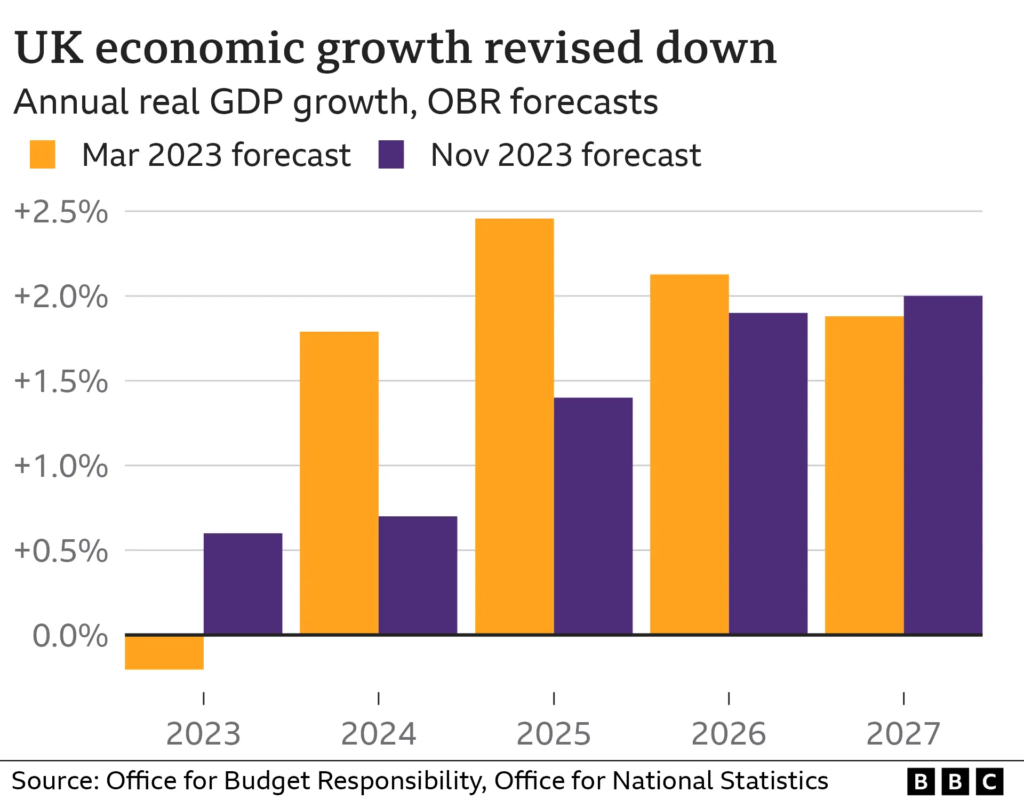

Recently, the OBR revised its growth forecast for the UK economy, now expecting a 0.6% growth in the current year, a significant improvement from its previous prediction of a recession and contraction. However, growth projections for 2024 and 2025 have been downgraded to 0.7% and 1.4%, respectively, from earlier estimates of 1.8% and 2.5%.

The OBR noted that while the economy has been more resilient to the impacts of the pandemic and energy crisis than expected, issues like persistent inflation and higher interest rates have posed challenges.

The Office for Budget Responsibility (OBR) cautioned that inflation, which currently stands at 4.6%, is expected to decrease to 2.8% by the end of 2024. It is only anticipated to meet the Bank of England’s target of 2% in 2025. This marks a shift from their earlier prediction, where they anticipated inflation would fall below the target more easily by next year.

The Office for Budget Responsibility (OBR) expects UK living standards, as indicated by real disposable income of households, to be 3.5% below their pre-pandemic level in 2024-25, before eventually returning to normal in the following years. This decline, although less severe than previously anticipated, is set to be the most significant drop since the Office for National Statistics began recording in the 1950s.

The UK economy is currently grappling with high inflation, increasing interest rates, and weak consumer demand, all contributing to sluggish growth.

In a more pessimistic outlook released earlier this month, the Bank of England predicted almost no growth for the UK in 2024 and 2025. The Bank has raised interest rates 14 times since December 2021 to combat rising prices, reaching 5.25%, the highest in 15 years.

The rationale behind increasing interest rates is to make borrowing costlier, thus reducing demand and slowing down price hikes. However, these higher rates can deter business investments and further slow down economic growth. The rise in interest rates has also affected households, with increased mortgage rates and impacts on property prices, which the OBR predicts will drop by about 4.7% in 2024.

Chancellor Jeremy Hunt, in his Autumn Statement, acknowledged that while the UK’s growth rate surpasses that of the eurozone, productivity improvements are necessary. He compared the UK’s private sector productivity unfavorably with that of the US, Germany, and France, attributing the gap to lower investment levels. Hunt proposed measures such as easing planning regulations, supporting entrepreneurs in raising capital, and reducing business taxes to bridge this productivity gap.

Furthermore, Hunt noted that government borrowing and debt, which have surged due to rising interest rates, are projected to be lower than the OBR’s previous forecasts for 2024 and 2025. This improvement is partly due to higher tax revenues from a stronger economy and a disciplined approach to public spending, according to Hunt.