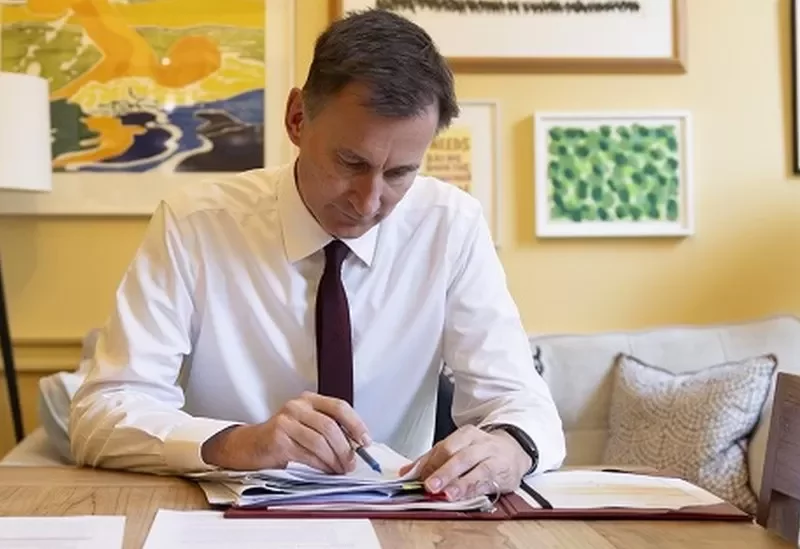

The chancellor is anticipated to reveal a reduction in National Insurance contributions for numerous employees during his Autumn Statement scheduled for later today.

Jeremy Hunt’s economic plan will include a decrease in business taxes and stricter regulations on benefits.

Additionally, he will introduce strategies aiming to increase annual business investment by £20 billion, aiming to stimulate economic growth in Britain.

According to the Institute for Fiscal Studies (IFS), tax rates in the UK are currently at their highest point in 70 years, based on historical records.

Labour’s shadow chancellor, Rachel Reeves, expressed that nothing stated by Mr. Hunt could alter the Conservative party’s “dreadful track record” regarding the economy.

Several Conservative Members of Parliament are eager to witness a reduction in the tax burden.

Former Home Secretary Dame Priti Patel mentioned, “This is a crucial moment. Conservative governments have historically implemented specific tax reductions aimed at increasing people’s disposable income.”

However, Dame Priti and many of her colleagues acknowledge that tax rates for individuals have risen, and there’s a widespread belief that public services haven’t progressed adequately alongside these increases.

The expenses incurred due to the COVID-19 pandemic and the high interest payments on the national debt, which are at their peak in decades, are considered by numerous economists as significant factors behind this situation.

Hence, the Autumn Statement represents Rishi Sunak’s latest effort to take control of the political agenda and bolster the Conservatives’ position in public opinion polls.

The Treasury team led by Mr. Hunt has taken minimal action to reduce speculations surrounding potential tax reductions.

Certain details from the Autumn Statement have already surfaced, such as a 9.8% raise in the minimum wage to £11.44 per hour, set to commence in April. This increased rate will now encompass 21 and 22-year-olds for the first time.

Mr. Hunt is also expected to outline a £2.5 billion overhaul of benefits for individuals with chronic health conditions or disabilities, as well as those encountering long-term unemployment.

The government intends to implement mandatory work experience placements or potentially terminate government support for benefit claimants who are unable to secure employment after 18 months.

Additionally, stricter penalties will be imposed on long-term unemployed individuals deemed insufficiently proactive in seeking employment, and there’s speculation about the potential removal of bus passes from those declining job offers.

Regarding businesses, it’s anticipated that the chancellor will prolong the tax break known as “full expensing” for businesses until 2028-29. This policy enables companies to deduct investment spending from profits, thereby reducing their corporation tax payments. Initially set to expire in 2026, this extension is on the horizon.

Currently, it remains uncertain whether Mr. Hunt plans to modify the levels or thresholds of National Insurance (NI). The NI rate stands at 12% for employees earning between £12,570 and £50,268, with 2% applied to profits exceeding this amount. Employees below pension age earning less than £12,570 yearly are unaffected by potential changes in NI policy.

“Refuse Increased Taxation.”

Mr. Hunt will emphasize, “Conservatives understand that a thriving economy relies more on the innovation and drive of the British populace rather than on government directives. We are committed to rejecting expansive government, excessive expenditure, and elevated taxation because we recognize that this approach stifles growth rather than fostering it.”

He’ll assert that the government plans to support British businesses through 110 growth-oriented measures, which involve streamlining planning regulations, attracting more foreign investment, and reducing business taxes.

In anticipation of the statement, Labour’s Rachel Reeves remarked, “The Conservatives have transitioned into the party advocating high taxation due to their association with sluggish economic growth. Following 13 years of economic underperformance under the Conservatives, the financial situation for working individuals has worsened. Inflation persists, energy costs have surged, and mortgage payments have increased due to the Conservatives’ mishandling of the economy.”

“Critical Juncture”

Amid expectations of an upcoming general election, the period leading up to the speech has involved typical political maneuvers, including hints, disclosures, briefings, and interviews. Speculation abounds regarding a wide array of potential tax reductions, and the Treasury hasn’t taken significant steps to temper these discussions.

Until recently, Mr. Hunt had minimized the likelihood of tax cuts, citing that they were “almost impossible” until inflation was brought under control. However, ministers have now indicated that tax cuts are on the horizon, emphasizing that they will be executed in a “responsible” manner.

During a speech on Monday, the prime minister repeatedly mentioned tax cuts and suggested that last Wednesday’s decline in inflation might indicate a pivotal moment for the UK’s sluggish economy.

Mr. Sunak stated that the government is now in a position to reduce taxes following a slowdown in the rate of price increases. He noted that his objective of halving inflation this year had been achieved. However, given the meager economic growth, the current emphasis is on reviving and stimulating economic expansion.